Mumbai: Global programmatic media partner MiQ has unveiled its Festive Shopper Insights 2025 Report, revealing how India’s festive shopping season is set to be defined by big-ticket spends, brand experimentation, and an early advertising race.

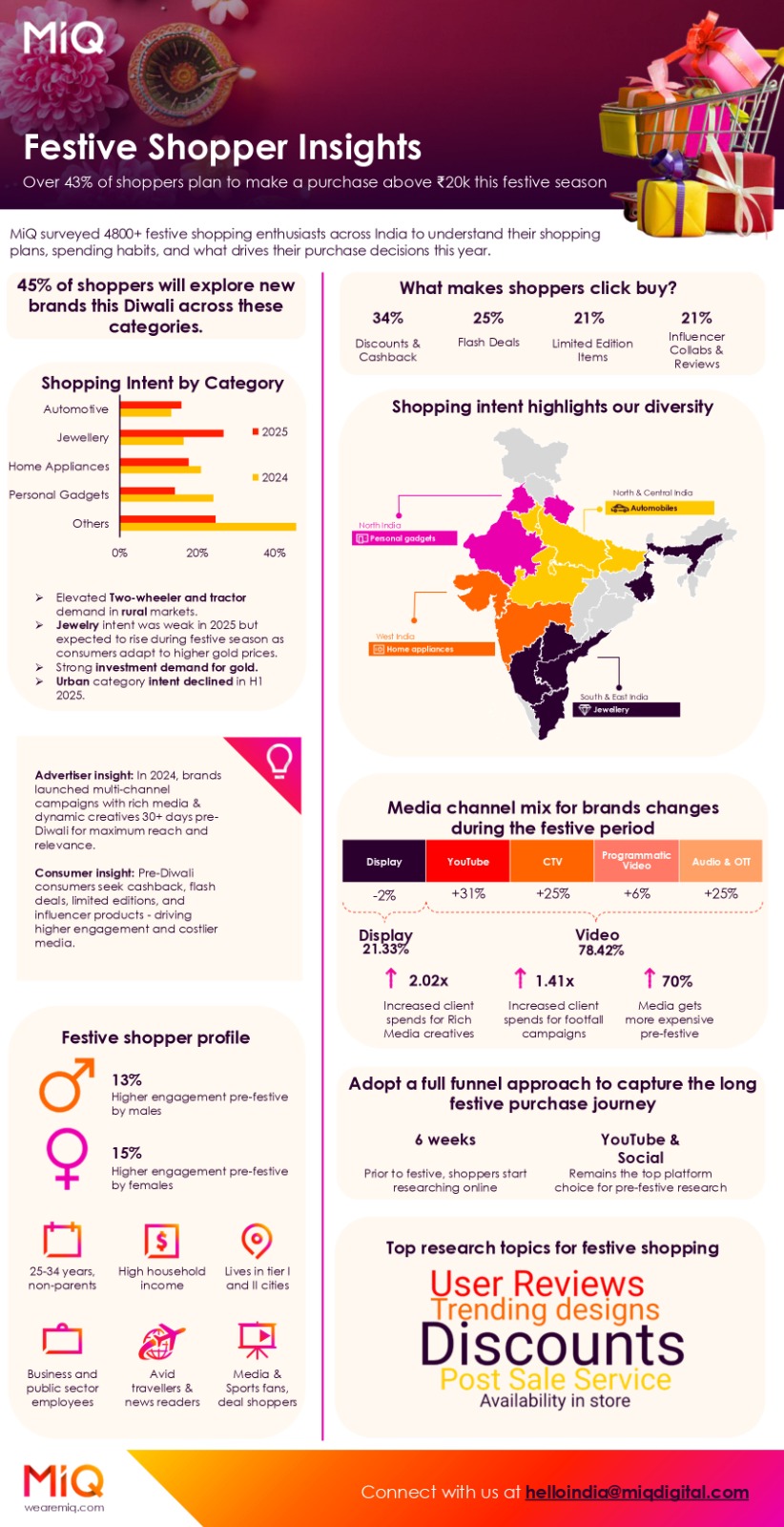

The study, based on inputs from over 4,800 festive shopping enthusiasts across India, highlights four major trends driving consumer behaviour this season – the rise of the ₹20,000+ confident spender, a surge in brand discovery, advertisers starting earlier than ever, and regionally distinct festive aspirations.

According to the report, 43% of consumers plan purchases above ₹20,000, pointing to a wave of confidence-driven spending across categories. The primary festive shoppers are high-income 25-to-34-year-olds from Tier I and II cities, with strong discretionary power and high digital adoption. These shoppers begin their journey nearly six weeks before Diwali, making early, multi-channel campaigns critical for brands.

Digital-first strategies are expected to dominate, with YouTube and social platforms leading discovery and deal hunting. Advertisers, in response, are frontloading spends on video, Connected TV (CTV), and OTT, even as CPMs surge, while traditional display loses ground.

The report notes that value and aspiration are both key motivators. While 34% prioritise discounts and cashback, another quarter are swayed by flash deals, exclusives, and influencer-led recommendations. Interestingly, gendered behaviours also emerge – males dominate the pre-festive research phase, while female shoppers increase engagement closer to Diwali.

Festive Trends to Watch in 2025

The Rise of India’s ₹20,000+ Shoppers

- 43% plan purchases above ₹20,000.

- Driven by deep discounts, exclusives, cashback, and influencer-led FOMO.

Brand Discovery Boom – The Year of the Challenger

- 45% of shoppers are open to trying new brands.

- Digital sampling, AR try-ons, influencer reviews, and viral campaigns are key decision drivers.

The Media Gold Rush – Diwali’s Early-Bird Advantage

- Advertisers launching campaigns 30+ days in advance.

- Programmatic video, shoppable social, and rich media lead spends amid rising CPMs.

Regional Pulse – Diverse Festive Aspirations

- North & Central India: High intent for automobiles, gadgets, and appliances.

- South & East India: Rural demand for two-wheelers, tractors, and jewellery despite gold price hikes.

- Urban India: Softer early categories, with gold holding strong as an investment.

Speaking on the findings, Varun Mohan, Chief Commercial Officer India at MiQ, said, “This festive season is no longer just about shopping, it is about cultural moments amplified by media. Our data indicates a new kind of Indian shopper who is confident, experimental and digitally led. For brands, the mandate is clear – launch earlier, speak authentically across regions, and embrace a full-funnel approach. At MiQ, we’re enabling advertisers to unlock these high-value festive moments with technology, data and creativity that deliver impact where it matters most.”

The report concludes that while shoppers are ready to splurge, brands face intense competition for attention. With festive CPMs inflating, marketers will need to rely on smarter omnichannel planning, influencer storytelling, and immersive activations to stand out.