WARC downgrades its expectations for global ad market growth by $90bn as the economic slowdown bites and social companies stall.

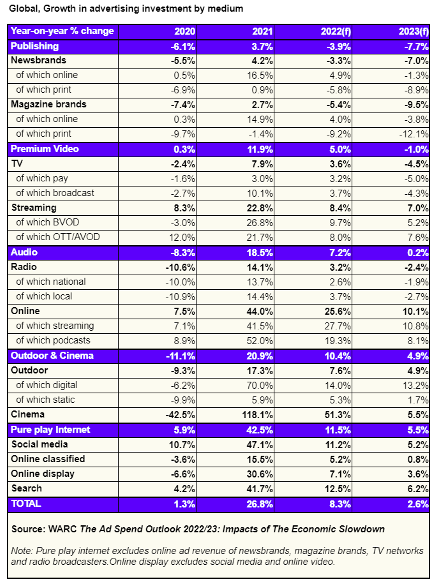

Global advertising spend is on course to rise by 8.3% – or $67.3bn – to $880.9bn this year, finds WARC, lifted by a positive first half for holding companies and a boost from cyclical events in the second, most notably the US midterm elections and the men’s FIFA World Cup in Qatar this November. Market growth is then set to ease significantly – to 2.6% – in 2023, as investment is inhibited by cooling economic conditions and third-party cookie blocking online.

The new projections, based on data from 100 ad markets worldwide, amount to a downgrade of 4.3 percentage points (pp) to 2022 growth and 5.7pp to 2023’s prospects, compared to WARC’s previous global forecast in December 2021. Taken together, the new forecasts represent a reduction of almost $90bn in growth potential for the global advertising market this year and next.

Advertising holding companies – which serve many of the world’s biggest brands – have recorded a positive start to 2022, with all major firms upwardly revising forward guidance for the year ahead. Conversely, small to medium-sized businesses (SMBs), who largely buy ad space directly, are bearing the brunt of worsening economic conditions. A slowdown in SMB advertising activity will impact social media companies most – a sector already struggling to grapple with the impact of Apple’s new privacy measures. WARC expects social media ad spend to rise 11.5% this year (compared to +47.1% in 2021) then ease to just 5.2% in 2023 – the slowest rate yet for the sector.

Aside from businesses, consumers are also feeling the squeeze of soaring price inflation. This is particularly true among low earners for whom energy and food costs comprise a higher proportion of income. Wealthier consumers, however, have seen the value of their assets appreciate in recent years and are more likely to have received above-inflation pay rises – spending intentions among high earners remain bullishly positive per Deloitte monitoring. Sectors like technology & electronics (+11.5% in 2023), pharma & healthcare (+7.5%) and household & domestic (+6.5%) are expected to post healthy increases in advertising investment to capture any available disposable income.

Social media’s $40bn shortfall

Apple’s move to block third party cookies across its 2bn devices – which are used by 12% of the global population (860m people) – has already had an adverse impact on the social media companies which rely on third party data, most notably Facebook-parent company Meta.

WARC believes that Apple’s privacy push – aside Google’s delayed move to block third party cookies from its Chrome browser (66% global market share) – will remove close to $40bn from the bottom line of these social media companies over the course of this year and next. A recent survey of over 1,500 practitioners for WARC’s Marketer’s Toolkit found that only a third (34%) of respondents felt fully prepared for a post-cookie advertising market.

Meta recorded its first annual decline in advertising income during Q2 2022 and WARC believes its full year growth will be flat over the forecast period, as the Instagram platform stymies ongoing losses from the core Facebook platform this year and next. TikTok (+41.5%), Snap (+5.8%) and Twitter (+2.7%) are all expected to record growth next year, but at a far slower rate than historically seen, while a number of Chinese platforms are set to record losses.

Very few product sectors are cutting advertising investment

Of the 18 product sectors monitored by WARC, all bar automotive are on course to increase advertising spend this year. Only four sectors are expected to cut spend in 2023; transport & tourism (-0.4%), alcoholic drinks (-1.1%), financial services (-4.5%) and automotive (-12.4%).

The technology & electronics sector – the third largest of the 18 monitored by WARC – is forecast to lead growth this year and next (+25.0% in 2022 and +11.5% in 2023), culminating in a total spend of $85.1bn by 2023. The pharma & healthcare sector then follows, with expected growth of 11.0% this year and a further 7.5% in 2023, by when investment will have topped $60bn globally.

Retail – the largest sector monitored by WARC and which includes Amazon, the world’s largest advertiser by spend – is set to increase advertising investment by 6.8% this year and 3.6% next year despite retailers seeing tighter margins from inflationary pressures. The automotive sector, however, is bedogged by both supply- and demand-side pressures and is the only sector set to cut advertising spend in both 2022 (-5.3%) and 2023 (-12.4%).

AVOD market heats up as streaming becomes war of attrition

Advertising spend in the video streaming sector is set to grow faster than the total ad market this year (+8.4%) and next year (+7.0%). Within this, the advertising-funded video on demand (AVOD) sector – which includes the likes of Hulu, Amazon Prime Video and YouTube – is expected to rise 8.0% this year and then a further 7.6% in 2023 to reach a value of almost $65bn.

Aside from the social media players, YouTube’s fortunes have also proven vulnerable to privacy changes on Apple devices; WARC believes that YouTube’s advertising revenue will rise 7.3% this year (compared to a 45.9% in 2021), but that its growth will then ease to 5.6% in 2023. This would give the company 39.4% of the global AVOD market, a declining share (down 0.9pp from 2021) as competition heats up with the introduction of advertising to Disney+ and Netflix later this year.

There is already evidence of saturation in the streaming market, particularly in the US, with audiences now using seven streaming services on average (compared to the global average of five). Consequently, new entrants are just as likely to be fighting for existing advertising spend as they are for incremental dollars, which could hinder overall growth of streaming operators in the short- medium-term.

Streaming services owned by broadcasters (BVOD) are also set to grow their advertising income this year (+9.7%) and next (+5.2%), but from a far lower base (reaching $18.5bn in 2023). Linear TV is set to benefit from cyclic sporting and political events this year, raising advertising investment by 3.6% to $180bn (20.4% of all advertising spend) but the market is then on course to record a 4.5% loss in the absence of these events next year.

Summing up, James McDonald, Director of Data, Intelligence & Forecasting, WARC, and author of the research, says: “With the growth rate of global output now set to halve and acute supply-side pressures fanning inflation, the economic slowdown has removed close to $90bn from global ad market growth prospects this year and next. Yet brands are still spending as the Covid recovery continues, and global ad trade remains on course to top $1trn in value by 2025. Platforms with rich sources of first-party data – most notably Amazon, Google and Apple – are well placed to weather future headwinds by offering measured performance in a climate where return on investment becomes paramount.”