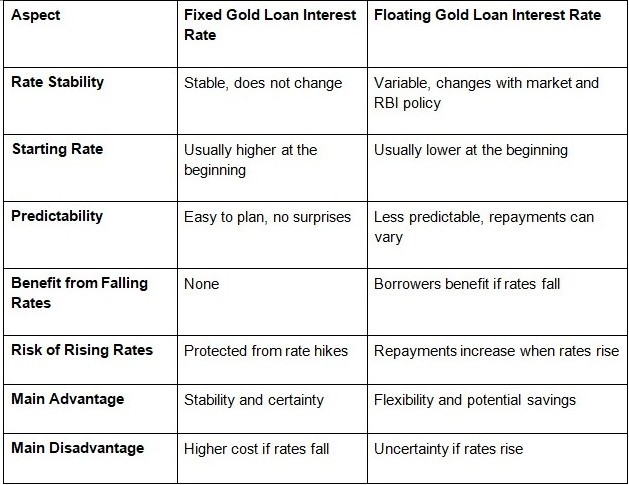

One of the most important decisions when taking out a gold loan is whether to choose a fixed or floating interest rate. The choice comes down to stability versus flexibility. Each option works differently, carries its own benefits, and responds in unique ways to changes in RBI policy. Understanding these differences helps borrowers make a decision that feels both practical and secure.

What Are Fixed and Floating Gold Loan Interest Rates?

A fixed gold loan interest rate remains constant throughout the loan tenure. This means your repayment amount does not change, regardless of market movements. A floating interest rate on a gold loan, however, moves in line with benchmarks or market conditions. As a result, your repayment amount may increase or decrease during the tenure.

Why the Rates Differ

Fixed and floating rates differ because of how the risk is shared between the lender and the borrower. A fixed rate is often slightly higher at the start, since the lender takes on the risk of future rate changes. In this case, the borrower pays a premium for stability and predictability.

A floating rate usually begins lower because the borrower accepts the possibility of change. If market rates rise, the cost of borrowing goes up. If rates fall, the borrower benefits. The lender, therefore, carries less long-term risk, which explains why floating rates often start more attractively.

Benefits of Fixed Rate

Following are the benefits of Fixed Interest Rate

1. Your monthly payment stays the same during the loan period.

2. It helps you plan and manage your budget easily.

3. You are safe from sudden increases in interest rates due to RBI or market changes.

4. It gives stability and peace of mind with fixed payments.

5. Makes it easier for families and businesses to plan monthly expenses.

6. Best for people with limited budgets or long-term loans, as payments don’t change even if the economy does.

Benefits of Floating Rate

Following are the benefits of Fixed Interest Rate

1. Floating rates help you save money when the gold loan interest rate goes down.

2. These rates change with the market, so your repayment amount can reduce if market rates fall.

3. They usually start lower than fixed rates, making them good for short-term loans.

4. If interest rates keep dropping, you may end up paying much less overall.

5. Floating rates are flexible and work well for people who can adjust their budget if needed.

6. They are best for borrowers who are comfortable taking a little bit of risk.

Disadvantages of Fixed Rate

Following are the drawbacks of Fixed Interest Rate

1. Fixed rates usually start higher than floating rates, leading to higher overall interest payments.

2. Borrowers may miss out on savings when market interest rates drop.

3. Less flexibility compared to floating-rate loans.

4. Often come with higher prepayment penalties.

5. May feel costly and rigid for borrowers planning early repayment or taking advantage of falling interest trends.

Disadvantages of Floating Rate

Following are the drawbacks of Floating Interest Rate

1. Floating rates change with the market, which makes payments uncertain.

2. Monthly payments can go up, causing financial stress.

3. They are not good for people who want fixed monthly budgets.

4. You need to watch market changes and adjust plans, which can be stressful.

5. When interest rates rise, floating loans can become costlier than fixed loans.

6. They are not suitable for people who avoid risks, have tight budgets, or long-term financial plans.

Fixed vs Floating Gold Loan Interest Rates: At a Glance

Impact of RBI Policy

The RBI controls floating gold loan interest rates through its benchmark rate decisions. The cost increase from policy rate hikes leads lenders to raise gold loan interest rates for their borrowers. The RBI’s rate reductions enable borrowers to obtain better repayment terms. The interest rates for fixed loans stay constant even when the RBI changes its policy rates.

Conclusion

The decision between fixed and floating rates of interest depends on your individual financial needs rather than which option provides superior benefits. People who need financial stability choose fixed gold loan interest rates because they protect against sudden rate fluctuations. People who handle rate changes well and want to benefit from decreasing interest rates should consider floating rate options. Your financial situation and comfort level determine which interest rate option works best for you.