Paris: Global communications group Havas reported a robust performance for the third quarter of 2025, posting +3.8% organic growth in net revenue, driven primarily by strong results in the United States and sustained progress across divisions including healthcare and media.

Reflecting confidence in its business model and challenger position, the company revised its full-year 2025 guidance upwards. Havas now expects net revenue organic growth between +2.5% and +3.0% (up from its earlier guidance of above +2.0%) and an adjusted EBIT margin improvement of around +50 basis points to 12.9% (previous range: 12.5%–13.5%).

Yannick Bolloré, CEO and Chairman of Havas, said, “Havas delivered a strong third quarter, achieving +3.8% organic growth in net revenue and demonstrating impressive commercial momentum, with notable new business wins both during the period and more recently, establishing a strong foundation for the future. Our Converged.AI strategy continues to drive measurable impact, helping clients operationalize AI across their marketing ecosystems with greater precision and efficiency. The launch of Horizon Global, our new joint venture with Horizon Media, marks a major strategic milestone, combining our strengths in a seamless, AI-native solution tailored to US-centric global client opportunities and the evolving demands of modern marketers. We remain committed to our strategic objectives and focused on scaling innovation, creativity, and performance across all markets. I want to thank our teams for their dedication and our clients for the trust they place in us.”

Strong Third Quarter Performance

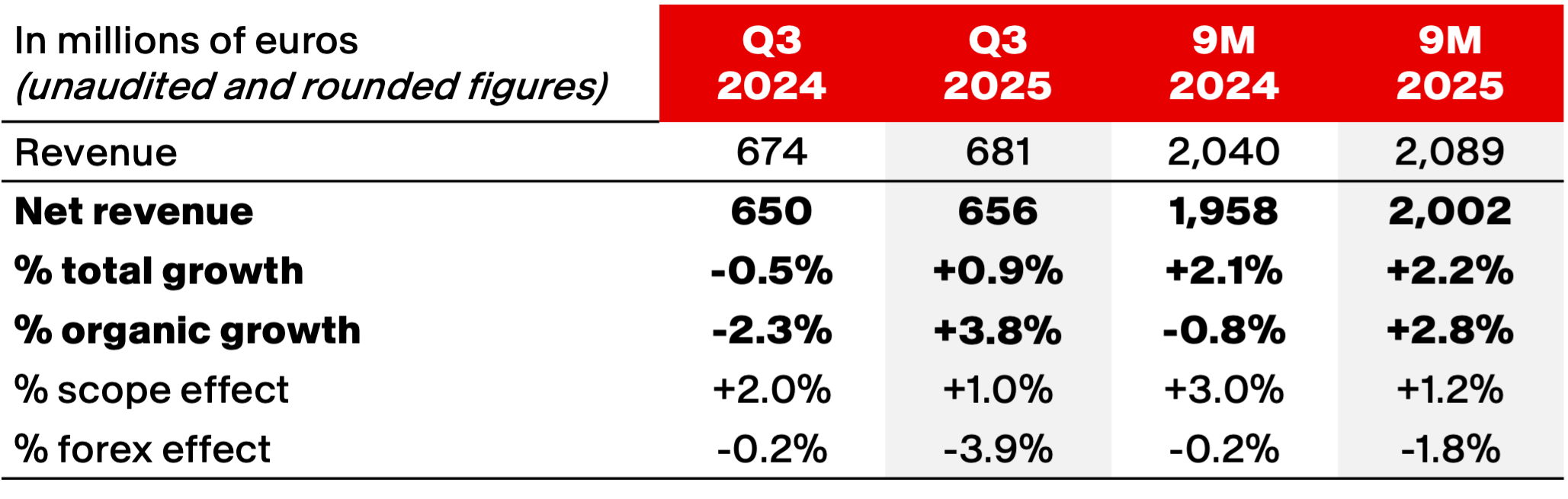

Havas reported net revenue of €656 million, up +3.8% organically compared to the same period in 2024, which had seen a contraction of -2.3%. Revenue for Q3 2025 stood at €681 million, representing a 1.1% increase as reported (or +3.9% on an organic basis).

The company’s North American operations led growth with a +7.4% organic increase, supported by double-digit gains in the Havas Health division, where clients expanded budgets and partnerships.

In Europe, revenue rose +1.9% organically, led by strong performances in the UK. APAC and Africa returned to positive territory with +8.2% growth, while Latin America saw a -4.6% contraction due to last year’s high comparison base.

For the first nine months of 2025, Havas achieved +2.8% organic growth, supported by solid expansion with its top 30 global clients under its “In-Business” strategy.

Strategic Developments

During Q3, Havas strengthened its digital and performance marketing capabilities with the majority acquisition of Tidart, a leading independent Spanish digital performance agency. This acquisition enhances the group’s presence in digital, e-commerce, and performance media, adding a diverse portfolio of mid-sized Spanish clients.

In September 2025, Havas also announced a landmark partnership with Horizon Media Holdings to create Horizon Global, a joint venture combining both groups’ expertise with $20 billion in combined global billings. The new entity is designed as an AI-native, data-driven media solution for modern marketers, focused on US-centric global opportunities.

Financial Activities

Financial Activities

Havas continued its share buyback program, repurchasing 8.77 million ordinary shares in Q3 2025 at an average price of €1.50 per share. Since the program’s start in June 2025, 11.37 million shares have been repurchased.

Additionally, Havas will implement a reverse share split (10 to 1) effective November 18, 2025, reducing the number of ordinary shares from 991.8 million to 99.2 million, with the nominal value per share increasing from €0.20 to €2.

Upward Guidance and Outlook

Havas sharpened its 2025 outlook, citing strong commercial momentum, strategic investments in AI, and the success of its acquisition and partnership strategies.

The company expects:

- Net revenue organic growth: +2.5% to +3.0%

- Adjusted EBIT margin: Around 12.9% (improvement of +50 bps)

- Dividend payout ratio: ~40%

Looking ahead to 2028, Havas reaffirmed its medium-term targets:

- Adjusted EBIT margin: 14.0%–15.0%

- Dividend payout ratio: ~40%

With a clear focus on innovation, AI integration, and sustainable client growth, Havas continues to solidify its position as a global creative and media challenger in the evolving marketing landscape.