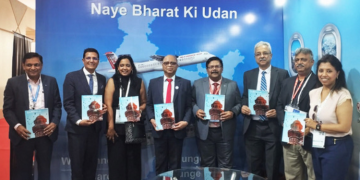

MUMBAI: Profitability is a challenge in the Online Curated Content (OCC) sector noted a new report by the Motion Picture Association (MPA) in collaboration with Deloitte. This was launched at the inaugural World Audio Visual Entertainment Summit (WAVES) in Mumbai.

The need of the hour for the Indian OCC sector is to focus on cutting losses and aiming for profitability, rather than focusing on subscriber growth and content expansion at the expense of profits. With competition intensifying and subscriber growth plateauing, the platforms need to prioritise sustainability. One of the biggest challenges is to crack the revenue model. Today, nearly all OCC services fall in the “freemium” spectrum (a combination of AVOD and SVOD).

The key is to find the sweet spot to attain profitability constantly battling to convert the free users into paid users. In addition, as OCC services are suffering losses, the streaming market is ripe for consolidation. While the deep-pocketed platforms can continue their operations due to regular fund injections from their parent companies, their smaller rivals are at risk of going out of business due to high content production costs and high user acquisition costs.

Increasing competition: This is another challenge. The ever-increasing competition in the OCC sector is a major challenge for the platforms in India. With 50+ platform players, a number which will only increase, vying for a share of the market, platforms are under pressure to constantly improve content quality, pricing strategies and user experience to stand out and retain subscribers in this highly fragmented landscape.

Other digital mediums, such as social media and YouTube, also pose a threat to the OCC as the social media and YouTube viewership continues to grow. Although the smaller platforms are struggling to produce high-quality content as they face budget limitations compared to the global giants such as Amazon Prime and Netflix, the Indian OCC sector is poised for a showdown due to the rise of regional platforms.

Platforms such as Hoichoi, Aha, ManaromaMax (Malayalam), Chaupal and OllyPlus (Odia) are gaining ground in the market with tailored localised content.[14] The share of regional language OCC titles increased from 47 percent n 2021 to 52 percent in 2023.

Regulatory changes: Although the central government has withdrawn the second draft of the Broadcasting Services Bill, the second draft of the bill has received a lack of support from the OCC services, which are concerned with the proposed regulations and registration requirements.

The proposed regulations in the bill may impose excessive government control and oversight on the content undermining the creative freedom of the content creators. The bill also introduces regulations for online advertising, establishing a new category of “advertising intermediaries” responsible for overseeing ad space on digital platforms.

Per the proposed bill, all online ads are required to comply with the Advertising Code, though there is a lack of clarity on whether the responsibility for ensuring the required compliance falls on the OCC service, the intermediary selling the ad space or the ad creator.

Economic impact

Direct impact

Gross output (direct): It reflects the combined revenue of the OCC sector. The gross output of Rs. 20,470 crore (US$ 2.4 billion) estimated below also includes indirect taxes paid by sector participants.

EBITDA: This metric reflects the total returns to capital employed and also captures the direct taxes (i.e. income taxes and corporate taxes) paid by the sector.

EBITDA was estimated at a negative INR 3,910 crore, as the sector is still in investment mode. It is to be noted that only a few players have started making profits in this sector.

Wages: It measures the returns to labour, which includes payments made to formally employed people in this sub-sector. Wage payments in FY2024 were estimated at Rs. 1,973 crore.

GVA (direct): It is the value-add created by labour and capital inputs, employed directly by the sector (i.e., EBITDA + Wages). In FY2024, this was estimated at a negative Rs. 1,937 crore.

NIT: For this study, the report has considered GST as the key indirect tax paid by the sector. GST collection details for the sector have not been formally reported yet. However, we have estimated this at Rs. 3,142 crore in FY2024.

Total value added (direct): This is the sum of the GVA and NIT. It represents the total direct impact of the OCC sector on the Indian economy. It has been calculated at Rs. 1,205 crore.

Employees (direct): Direct employment figures include on-roll employees of OCC companies. Employees in OCC services include in-house production staff and non-production roles such as sales, finance and HR. OCC companies were estimated to employ 23,000 people in FY2024. Employment generated by the commissioning of original content is reflected in the producti n numbers of film and TV.

Sports as a growth avenue for OCC services

Sports consumption in India has transformed over the years, and the advent of OCC services has undoubtedly changed how audiences engage with live sports events. One of the most significant indicators of an OCC service’s popularity is its subscriber strength.

The quest to secure streaming rights for live sports has become a key strategy for every OCC service to gain prominence in a viewer’s eyes. Live streaming of sports events is an automatic winner as far as earning new subscribers is concerned.

Jio Cinema’s decision to make Tata IPL free for all users in 2023 across mobile, web and CTVs was a turning point in the history of live sports streaming in India. This led to an inflection point, with 449 million viewers tuning in to watch the tournament. The viewership grew by 38 percent to 620 million viewers in 2024.

To further diversify its content, Jio Cinema collaborated with short-form video apps such as Sharechat and Moj to deliver exclusive content from the 2024 Paris Olympics. This collaboration underscores Jio Cinema’s strategy to enhance viewer engagement through multi-platform content distribution.

Moreover, it is estimated to account for about 50 percent of Premium AVOD (Advertising Video on Demand) revenues in India for 2023, highlighting its significant influence in the sports streaming market.

Sony LIV recorded a 50 percent increase in users, a 64 percent increase in total views and a 350 percent increase in live views during the UEFA EURO 2024, compared with the initial days of the Euro 2020 championship.

The competitive environment has also led platforms such as Amazon Prime Video to enter the sports streaming arena. Recently, Amazon Prime Video secured the rights to broadcast New Zealand’s cricket matches until the 2025-26 season, marking its expansion into sports content in India. This move demonstrates the growing trend of integrating sports streaming across different platforms.

Disney+ Hotstar, at its peak, reported 61.3 million subscribers in the quarter ending September 2022 but it has gradually declined since it lost the digital rights to stream IPL to JioCinema in 2024. The falling subscriber trend indicates the importance of live sports for streaming.