Mumbai: TransUnion CIBIL, an insight and information company, is celebrating 25 years of building trust in the country’s credit ecosystem with a unique, storytelling-led brand and consumer outreach campaign.

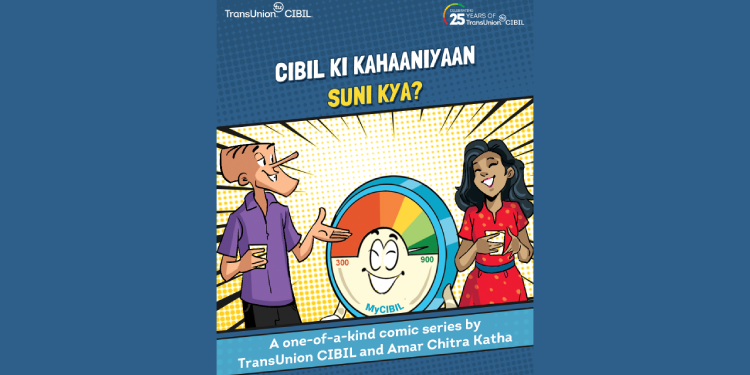

At the centre of its silver jubilee celebrations is ‘CIBIL Ki Kahaniyan’, a special edition of the legendary Tinkle comic book created in collaboration with Amar Chitra Katha. Featuring Tinkle’s iconic character Suppandi, along with two new companions — Simran, his finance-savvy friend, and MyCIBIL, a friendly personification of the CIBIL Score — the comic simplifies credit concepts in a fun and engaging manner. Through humour and relatable storytelling, the characters explain the role of a credit bureau and highlight how responsible credit behaviour impacts the CIBIL Score.

Appealing both to adults who grew up with Suppandi and to younger readers beginning their financial journeys, the comic blends nostalgia with financial awareness. Read the special edition here: CIBIL Ki Kahaniyan.

In parallel, TransUnion CIBIL has rolled out a multi-channel campaign across print, social media, and radio with the tagline, ‘Sahi CIBIL Score, Badhaaye Khushi Ka Score’ (“The right CIBIL Score can increase your happiness quotient”). The campaign highlights how a healthy credit score enables modern aspirations such as buying a home, funding education, or starting a business.

Bhavesh Jain, MD & CEO, TransUnion CIBIL, said, “This milestone is not merely a reflection of time, it is a testament to the trust we’ve earned and the impact we’ve made. For 25 years, TransUnion CIBIL has played a foundational role in supporting India’s credit ecosystem. These campaign initiatives are designed to show how credit has enabled progress and been a catalyst for transformation. We are proud to have contributed to India’s financial journey and remain deeply committed to advancing inclusive and responsible credit access.”

“Behind every CIBIL Score is a story of dreams pursued, of resilience, and of progress. We hope that the stories we share through these campaign partnerships will inspire more people to learn about credit scores and responsible credit behaviours. Our focus remains on deepening our impact by helping communities across India access the opportunities they deserve. We are grateful to be part of this journey and remain committed to building a more inclusive and resilient credit ecosystem for all,” added Jain.

V. Anantharaman, Chairman, TransUnion CIBIL, said, “Over the past 25 years, TransUnion CIBIL has stood for trust, transparency, and financial empowerment. Our journey reflects the strength of the partnerships we have built. We have worked closely with regulators, lenders, and ecosystem players, and each step has reinforced our role in shaping India’s credit environment. We remain committed to making it inclusive as we continue to lead with information and insights, and stay focused on building a system that is ready for the future.”

Gayathri Chandrasekaran, Editor-in-Chief of Tinkle, added, “Suppandi’s simplicity and comic timing make him one of India’s most loved comic characters, appealing to children and adults alike. Who better than him to demystify the world of credit scores and credit ratings? We also created two mascots, Simran and MyCIBIL, who along with Suppandi, promote credit literacy via comics. Our motto at Tinkle is ‘Where Learning Meets Fun’, and Amar Chitra Katha is very happy to have partnered with TransUnion CIBIL to make credit awareness and empowerment accessible to all. The process of creating ‘CIBIL Ki Kahaniyan’ was very interesting for us, and I’m happy to say our team has started checking their CIBIL score regularly!”

Over the past 25 years, TransUnion CIBIL has connected with more than 7,000 institutions, enabling better-informed lending decisions. As of July 2025, 164 million consumers have self-monitored their CIBIL Score and Report.

In this period, more than 700 million individuals in India have gained access to formal credit, while over 36 million commercial entities and 85 million active microfinance borrowers have been empowered. Notably, 118 million women have entered the formal credit system in the past decade, strengthening financial independence. With credit adoption surging among younger and first-time borrowers, TransUnion CIBIL continues to play a pivotal role in fostering inclusive growth.