New Delhi: India’s television advertising market witnessed a year-on-year decline of 11% in ad volumes in 2025, reflecting a phase of recalibration after sustained growth in previous years, according to the TAM AdEx – 2025 Television Advertising Recap.

Measured in secondages, television ad volumes softened significantly in the latter half of the year, even as advertisers demonstrated tactical bursts during select periods. While the second quarter of 2025 recorded a 6% growth over Q1, advertising momentum weakened toward the year-end, with Q4 volumes declining 10% compared to Q3, the report noted.

FMCG Drives the Medium

Despite the overall contraction, television remained firmly anchored by fast-moving consumer goods (FMCG) advertisers. Food and Beverages emerged as the largest advertising sector, accounting for 21% of total TV ad volumes, followed by Personal Care and Personal Hygiene at 15% and Services at 14%.

Household Products and Personal Healthcare rounded off the top five sectors, underlining television’s continued strength as a reach-led medium for mass consumption categories. The top 10 sectors together contributed 87% of total TV ad volumes, highlighting a high concentration of spend among scale-driven categories.

Hygiene Categories Lead at the Micro Level

At the category level, Toilet Soaps and Toilet/Floor Cleaners jointly topped the charts, each commanding 6% share of total ad volumes, followed by Washing Powders and Liquids at 4%. Hygiene-linked categories continued to retain their leadership positions from 2024, reflecting sustained consumer demand and brand competition.

Notably, Retail Outlets – Jewellers recorded one of the sharpest rank improvements, moving from 16th position in 2024 to 9th in 2025, signalling renewed advertising momentum from the jewellery retail segment.

Growth Pockets Amid Overall Decline

While headline volumes declined, the report highlighted that over 170 advertising categories registered positive growth during the year. Toilet/Floor Cleaners posted the highest increase in absolute ad volumes at 13%, while Vocational Training Institutes recorded the fastest percentage growth, expanding 2.5 times year-on-year.

Other high-growth categories included e-commerce financial services, branded jewellery, online matrimonials and aerated soft drinks, indicating television’s continued relevance for trust-led, life-stage and aspiration-driven categories.

Advertisers and Brands: FMCG Muscle Remains Strong

Hindustan Unilever retained its position as India’s largest television advertiser, contributing 14% of total ad volumes in 2025. It was followed by Reckitt Benckiser (India) and the Godrej Group. FMCG players dominated the advertiser rankings, with the top 10 advertisers accounting for 44% of total TV ad volumes.

At the brand level, Dettol Toilet Soaps emerged as the most advertised brand on television, followed by Harpic Power Plus variants and Dettol Antiseptic Liquid. Seven of the top ten brands belonged to Reckitt Benckiser, underscoring its aggressive, multi-brand television strategy.

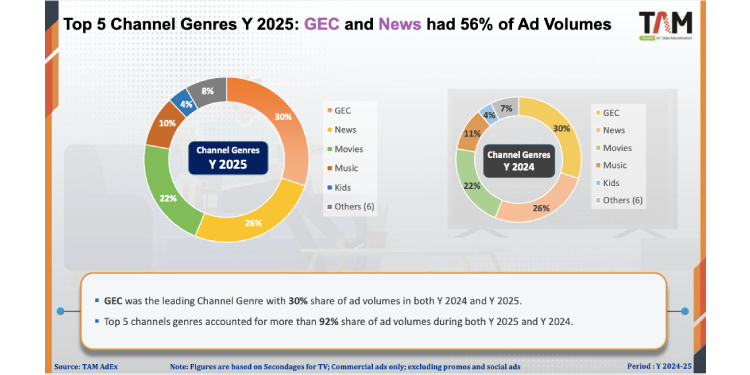

GECs and News Channels Command Ad Share

Genre-wise, General Entertainment Channels (GECs) continued to lead with a 30% share of ad volumes, while News channels followed closely at 26%. Movies accounted for 22% of volumes. Collectively, the top five channel genres contributed over 92% of total television advertising, mirroring the genre concentration seen in 2024.

Co-Branding with Movies Gains Scale

Co-branded advertising with movies emerged as a significant television trend in 2025. Brands partnered with films for over 570 hours of co-branded advertising, with nearly 60 movies participating in such associations.

Among the top collaborations, Comfort Fabric Conditioner led co-branded advertising, while brands associated with Pushpa 2 alone accounted for 23% of total co-branded ad volumes. The data points to movie-linked co-branding evolving into a scalable and repeatable strategy rather than a one-off promotional tactic.

A Year of Strategic Reset

The TAM AdEx report suggests that 2025 marked a year of strategic optimisation for television advertising, rather than a structural decline. While volumes moderated, advertisers continued to rely on TV for mass reach, category leadership and high-impact brand building, albeit with sharper planning and selective deployment.

As brands balance investments across digital, connected TV and traditional platforms, television’s role appears to be shifting from always-on presence to precision-led, burst-driven strategies anchored by high-reach genres and established categories.