Article by Mathias Chaillou, Chief Executive Officer, Performics Greater China Chief Integration Officer, Publicis Media Greater China

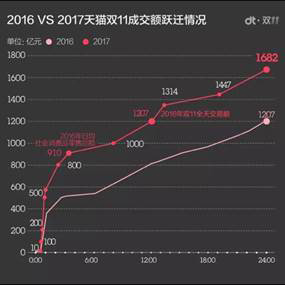

Looking back at the latest edition of 11.11, the overwhelming feeling is that basic laws of economics don’t always prove to be true: diminishing returns and soft growth landing do not seem to apply to this unique shopping and shipping festival that has clearly become a ritual with consumers. With 168.2 Billion RMB in GMV, the growth of the 2017 edition surpassed the one of the 2016 edition (+39% in 2017 vs. +32% in 2016 GMV increase).

Miracles don’t come by surprise, and Alibaba’s relentless efforts to grow this event will one day be part of marketing books. So, what has changed in this edition? Why has it been such a success? What can we learn?

First and foremost is the importance and effort that brands have put into preparing for this event. No stone was left un-turned. For most of our clients, 11.11 has required four months of dedicated planning covering all marketing levers. This year, all brands were prepared with global brands really stepping up. What we have seen is a premiumisation of 11.11 with more premium brands putting in more effort, and more consumers responding to these brands’ solicitations. This shows that when brands really adopt marketplaces and adapt their strategies to shopping festivals, when they put forward the right products, the right incentive and even more so the right content, there is a huge potential market that is far from being saturated. The growth of premium brands has been as much as three times as high as for mass market brands. And 60% of consumers say they saw 11.11 as an occasion to try premium and luxury goods they would not buy otherwise (source: Lightspeed). Many luxury and premium brands joined the 10 0 Million GMV club. Brands like Chow Tai Fook, Dyson, UGG or Aptamil performed particularly well in this edition with little or no discounts. In the prestige Beauty category, Lancôme, Estée Lauder and SKII results were beyond expectations.

The orchestration of 11.11 by TMALL and brands has led to consumers buying more, but also earlier. Brands have not only been active during 11.11. Many of them started communicating up to a month before the official start. We saw shopping carts filling up as early as October 1st and pre-sales really hitting records in the first 24 hours (October 20th) with almost 25% of all pre-sales generated in the first day of 11.11. Strong pre-sales in the opening days is not a new phenomenon but we did see that brands who did start early saw their pre-sales numbers go through the roof. All this has resulted in a sense of anticipationthat really reached new heights in 2017. This proved to be true on the day of 11.11 itself, where Nike for example, reached 100 Million GMV in less than 1 minute. While this is great for consumers and for TMALL, this also means consumers have delayed purchases to benefit from discounts. This being particularly true in the apparel, electronic and beauty categories where, respectively, 55%, 30% and 24% of consumers delayed their purchases according to Fung Global Retail & Tech. This continuous trend will lead to more conversation about first degree (AKA “perfect”) price discrimination to improve margins in the coming years.

Another phenomenon that gained traction has been the adoption of the new retail strategy. This has been particularly true in the fashion category, but many other categories such as beauty and infant milk formula have also widely adopted omni-channel and O2O initiatives. Many brands have activated their own events or partnered with some of TMALL’s Pop-up stores to promote their products, leveraging both deep consumer experience all the while turning this experience directly into sales. If the numbers for O2O don’t really affect the bottom line (yet!), retailers and brands have used this occasion to test and learn strategies, preparing for the future. Uniqlo for example saw omni-channel GMV increase over four times (source: Alibaba)

The gamification of 11.11 has been a key element in consumer engagement. There have been the more obvious games that enable consumers to get extra incentives, but what we have found particularly interesting has been how commercial offers have become so complex that navigating them was in itself a game. If you add the in-store game in pop-up stores, leaderboards, VR, red envelops… you have there an ecosystem that has truly taken the shape of a game. And that is exactly the type of experience that younger consumers are looking for in their shopping journey today. However, it is to be noted that the level of complexity has gotten such that 75% (source: Nanfang Metropolis Daily) of consumers found it “too complicated” and “time wasting”. Some forms of discounts (cross-shop discounts, down payment giving rights to additional discounts…) may need to be revised in the future to give more transparency to pricing. And while VR and AR have huge potential it has not yet really picked up. While the emphasis on gamification has been a success, a more consumer-focused playing field would benefit all parties moving forward.

Last, we have seen for the first-time real excitement picking-up outside of China. We saw Alibaba invest in logistics, delivery and payment facilities in Taiwan, Hong Kong, Singapore and Malaysia to accelerate regional adoption. Lazada, a Southeast Asia marketplace which Alibaba owns shares in, has strongly promoted the event. More surprisingly, in Singapore for example, Watson has put forward 11.11 promotions on their own website. MediaMarkt in Germany, just to name another large E-Commerce player, also had a single day’s dedicated section on its platform. With orders coming from 225 markets,Globalisation is on its way.

What are the first lessons we can draw, a few hours only after this frenzy?

- There are two crucial moments to 11.11. Before it starts, when brands need to stimulate demand and incentive users to put their products in their shopping carts. The other game changing moment is the three first hours of D-Day. Numbers show that all the incremental sales in 2017 were pretty much made during these three hours (pre-sales confirmation and new offers being released). Local brands (Pechoin, Vinda, PurCotton,…) have been particular strong putting forward great offers and super-packs.

- Many consumers are willing to upgrade, so 11.11 is a huge opportunity for premium brands. Lower price items and smaller formats may help to grow your consumer base.

- Keep it simple and consistent. Be clear about your commercial offer. Make sure any bonus gifts are relevant to the consumers (sample of the same products vs. samples of other products for example).

- The leaderboards and ranking system gives more visibility to bigger brands. Smaller brands should be more focused on the SKUs they put forward and the audiences they address.

- Make sure you leverage all CRM capabilities, including in paid media. Existing buyers are the low hanging fruit and will help you boost organic visibility.

- Increase the frequency of posts on content channels, especially in the last days. Some local Brands were publishing up to 10 pieces of content in the last days. Livestreaming and real buyer reviews should at the core of your strategy.

We had recently underlined the importance of 11.11 for our clients and concluded that it had replaced CNY in the world of marketing. The scale, the planning, the excitement, the efforts and passion we put into this event had somehow replaced the commercial hype of CNY. In light of the results from this year, we are tempted to say it awfully feels like an early Christmas for brands and consumers.