New Delhi: In an industry where year-end communications are often ceremonial, the note from Rahul Joshi, Managing Director of Network18, stands out as something else entirely: a candid diagnosis of where Indian news media stands—and a blueprint for where it must go next.

The backdrop, as Joshi makes clear, is unforgiving. “Despite a very tough year for advertising-led media companies… your company has beaten the odds and grown,” he writes, acknowledging the widespread contraction across news organisations in 2025. But the real signal lies in what he identifies as the driver of that growth—not scale, but relevance.

From Scale to Significance

“More importantly, we have gained relevance share by focusing less on the obvious, the routine, the mainstream and the traditional,” Joshi notes. In an ecosystem still obsessed with traffic spikes, TRPs, and GRPs, this is a telling reframing. Relevance, not reach, is positioned as the new growth currency.

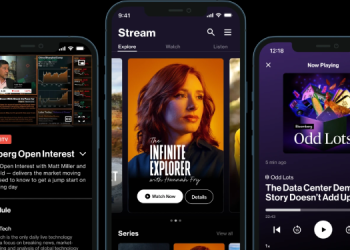

That philosophy underpins Network18’s growing engagement with the creator economy. The launch of Creator18 is framed not as an experiment, but as a structural response to how audiences now discover content. As Joshi puts it, “The idea is simple—offer them a platform to showcase their creative, cutting-edge, relatable content.” The commercial logic is equally direct: “We grow their market share, they our relevance and audience share, and both our revenue share.”

De-Risking the Revenue Model

A second, equally important theme running through the note is revenue diversification. With traditional advertising under pressure, Joshi is explicit about the need to de-risk the business. “Our subscriber base is growing the fastest, our transactions business is gaining scale, our new business ideas such as Creator18 keep us relevant,” he writes, underscoring a deliberate shift away from ad-only dependence.

Nowhere is this clearer than in the group’s business news portfolio. “With CNBC-TV18 and Moneycontrol, we’re laying emphasis not on click-baity content but access to high-quality tools, research and insights,” Joshi says—positioning subscriptions, premium products, and utility-led offerings as long-term value creators. Moneycontrol Pro’s million-plus subscribers, the introduction of SuperPro, and the scaling of its lending platform point to a future where news brands monetise intelligence rather than volume.

Joshi also draws attention to a less-discussed growth lever: India’s regional and hyperlocal markets. With regional clusters expanding across languages and a sales force reaching advertisers in “every nook and corner of the country,” Network18 is building scale where national media often struggles. Digital outreach, in this context, becomes not just a distribution strategy but a revenue unlock for smaller advertisers beyond metros.

Reimagining News for a Gen Z World

Perhaps the most striking—and blunt—section of the communication is Joshi’s assessment of traditional news itself. “Old is gold but gold has peaked,” he writes, summing up the challenge facing legacy formats. Gen Z, he observes, “is not reading newspapers but watching reels, not watching TV but looking for insta gratification.”

The implication is clear: format inertia is no longer an option. “The old traditional formats are irrelevant and viewers are not paying attention,” Joshi warns, adding that “news is fast getting replaced by nuance and nous.” In an AI-driven environment where speed and summaries are increasingly automated, he argues, “real intelligence will separate the wheat from the chaff.”

Digital-first brands like Firstpost and Kadak are positioned to lead this shift, while News18 India and CNN-News18 are expected to step up their CTV and social-first strategies to meet audiences where they actually are.

A Leadership and Cultural Signal

Beyond strategy, the note also serves as a leadership statement. Marking ten years at Network18, Joshi outlines a clear cultural priority for the year ahead: “Hire young, think younger, dream bigger—that should be the motto in 2026.” In an industry still shaped by legacy hierarchies, the emphasis on empowering younger leaders is as significant as any business pivot.

For the broader media industry, Joshi’s message is difficult to ignore. “We made 2025 count in what was for many a very challenging year. Let’s make 2026 rock,” he concludes—less a sign-off than a call to action.

The larger takeaway is this: the future of news will not be secured by defending old formats or waiting for advertising cycles to rebound. It will be shaped by relevance over reach, intelligence over immediacy, diversified revenues over single-point dependence—and a willingness to reimagine what a news organisation is meant to be in a post-headline world.