O3+ is a professional skincare brand—trusted by over 100,000 beauticians and present in 25,000+ salons from Tier One to Tier Three cities.

Founded in 2004 by Vidur’s father, Vineet Kapur, O3+ disrupted the professional skincare ecosystem by introducing science-backed facial treatments tailored for salon professionals. Over the years, the brand has evolved from a just a salon-exclusive label to a direct-to-consumer (D2C) force, bringing salon-like glow to homes across India through daily skincare products designed for ease, efficacy, and modern routines.

O3+ is a trusted name across India’s salon ecosystem—setting the gold standard for professional facials. Whether it’s a routine salon visit or selecting a bridal package for the big day, O3+ is often the first choice for its superior quality and salon legacy.

Medianews4u.com caught up with Vidur Kapur Director O3+ Professional

Q. O3+ was launched two decades ago, building on O3 which launched in 1967. How have the principles of education, innovation, and business growth given it a competitive advantage?

Education has always been central to our growth. From the start, we invested in training beauticians and salon professionals through our academy and workshops. This not only built trust within the professional community but also positioned O3+ as a brand that empowers and uplifts the people who use our products daily.

Innovation has been the other key driver, with launches such as the Hydrogel Mask and collaborations like O3 X Mijoo Korean, alongside trusted favorites like the D-Tan Pack and Bridal Facial Kit. These kept us relevant across generations of consumers.

On business growth, being consistent and disciplined gave us a strong base. Rather than expanding too quickly, we reinvested profits into R&D, building new facilities, and strengthening our distribution network. This steady approach ensured we stayed profitable and competitive, while creating a brand that balances heritage with continuous evolution.

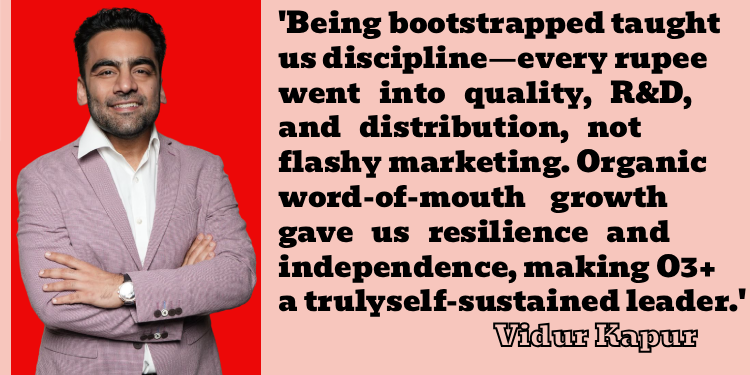

Q. How did the company overcome the challenge of being bootstrapped and growing profitably without external funding?

Being bootstrapped meant we had to be cautious and selective in our investments. Every rupee went into quality, R&D, and building distribution, instead of heavy marketing spends. We focussed on creating products that would naturally gain word-of-mouth recognition among beauticians and customers, which allowed us to grow organically without external funding.

This independence also gave us the freedom to stay true to our values. Without investor pressure, we could expand at a pace that was sustainable, prioritizing profitability over aggressive scale. Over time, this has given us financial resilience and positioned O3+ as one of the few self-sustained leaders in the skincare space.

Q. Could you shed light on the tactics used that helped the company move from being a salon-focused skincare brand to a multi-brand beauty enterprise?

The shift started when we entered retail in 2012. We recognized that while salons were our stronghold, consumers wanted to take professional-quality skincare home. We then introduced multiple sub-brands such as Agelock, Sara, and Laamis to cater to different needs, while keeping salon professionals at the centre of our strategy. At the same time, innovations like the Hydrogel Mask and collaborations like O3 X Mijoo Korean gave us new consumer touchpoints, while the D-Tan Pack and Bridal Kit ensured strong recall and trust.

We also expanded our channels beyond salons – entering e-commerce, pharmacies, modern trade, and now quick commerce. By balancing professional credibility with consumer accessibility, we managed to transform O3+ into a multi-brand beauty enterprise without losing our salon-first DNA.

Q. Other beauty brands use celebrities. Was using beauticians a deliberate effort to counter the program? How effective has that been in spreading the message?

Yes, it was a very deliberate choice. We always believed that beauticians are the real experts and their recommendations are far more credible to customers than celebrity endorsements. By putting the spotlight on beauticians, we not only recognized their contribution but also built a strong sense of loyalty within the professional community.

This strategy has worked very well. Word-of-mouth from beauticians carries trust and authenticity, and it has helped our brand expand organically across cities and towns. Instead of quick visibility through celebrities, this grassroots approach created long-term credibility and deeper relationships with consumers.

Q. What marketing campaigns and innovations can one expect in 2025 and 2026? What will the media mix look like?

Our focus will be on driving campaigns around innovation and consumer engagement. For instance, the O3 X Mijoo Korean collaboration will be supported with creative social media, influencer partnerships, and tutorials, while new innovations like the Hydrogel Mask will see dedicated campaigns.

At the same time, our hero products like the D-Tan Pack and Bridal Kit will continue to be central to our messaging as they remain consumer favorites.

The media mix will be digital-first, with strong focus on social platforms, influencers, and quick commerce-led promotions. However, we will also complement this with offline activations, in-store branding, and selective print or TV campaigns for mass awareness. This balance ensures we reach younger digital-first audiences while still engaging traditional consumers.

Q. Could you talk about the importance of growing the company’s presence on quick commerce platforms like Blinkit and Zepto?

Quick commerce is becoming a major growth channel because skincare is now an impulse and convenience-driven category. Platforms like Blinkit and Zepto already contribute significantly to our online sales, and we see them as vital for reaching younger urban consumers who prefer instant access.

We are developing exclusive kits and promotional offers tailored for these platforms, making O3+ a part of everyday shopping. Strengthening our quick commerce presence also allows us to stay competitive and top-of-mind, while ensuring customers can access our products whenever they need them.

Q. Has it been a challenge to drive relevance for a heritage brand in the clustered beauty market among Gen Z?

Yes, staying relevant with Gen Z in a crowded beauty space is a challenge, but also an opportunity. We have addressed this by creating products that fit their lifestyle – like the O3+ Hydrogel Mask for quick results and our O3XMijoo Korean collaboration, which taps into the popularity of K-beauty. These connect well with younger consumers who seek convenience and global trends.

At the same time, our heritage remains an advantage. Gen Z values authenticity, and our professional credibility gives us that trust. By blending legacy products like the D-Tan Pack and Bridal Kit with new innovations, we appeal to both long-time users and younger audiences, ensuring we remain relevant across demographics.

Q. In terms of international expansion the company is already in over 100 salons in Dubai. Which are the key countries being looked at and how confident are you of competing with those countries’ homegrown brands?

We are expanding into markets such as Bangladesh, Sri Lanka, Mauritius, and parts of Africa, in addition to our presence in Dubai. These regions show strong demand for professional-grade skincare and openness to Indian brands with proven quality.

We are confident because our professional expertise and salon-first approach make us a strong differentiator. We also adapt our products to local climates and preferences, ensuring relevance in each market. With the positive response in Dubai, we believe we can successfully compete with homegrown brands abroad.

Q. What role does data analytics play in TG segmentation and pricing?

Data analytics is central to how we understand and serve our customers. By tracking sales, regional demand, and consumer behavior, we segment our audience effectively – whether it is salon professionals, Gen Z buyers, or Tier-2 consumers – and customize campaigns accordingly.

It also guides our pricing. We study consumer willingness to pay, competitor benchmarks, and regional purchasing power before fixing prices. Campaigns and promotions are refined based on real-time data, ensuring our products stay competitive, accessible, and profitable.