Mumbai: Drawing on years of shopper research across categories and sectors, Ipsos has released fresh insights into how consumers make purchase decisions and how the role of branding shifts across different buying contexts.

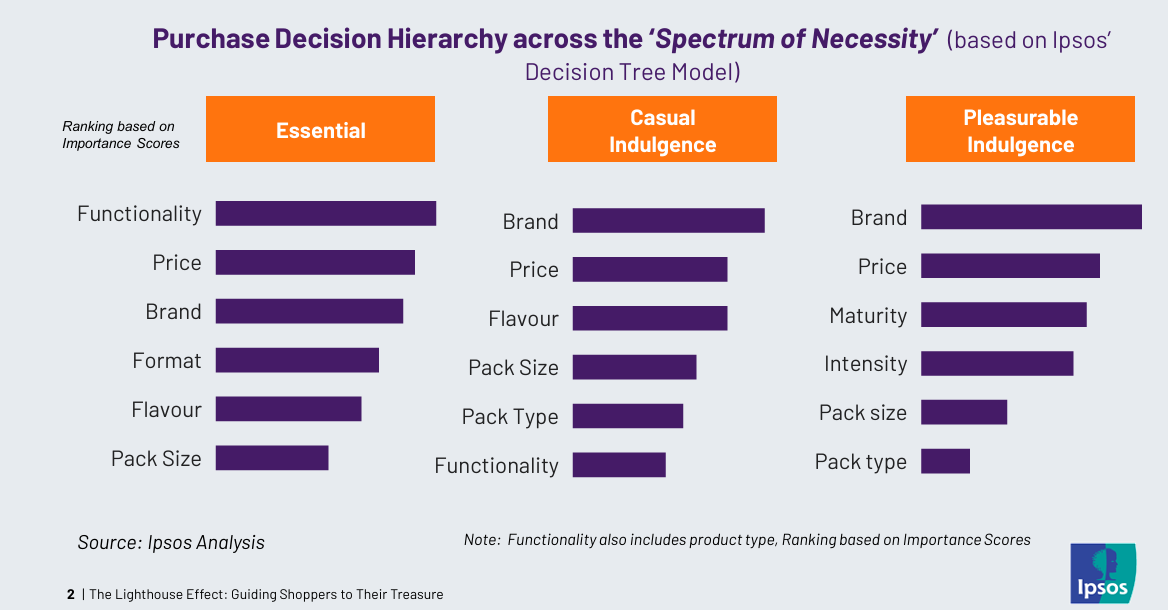

The Ipsos Shopper Insights team has synthesised findings from extensive client studies to uncover the underlying logic shaping choice at the point of purchase. Central to this thinking is a Decision Tree, also referred to as the Purchase Decision Hierarchy, which maps the attributes shoppers evaluate as they move through needs, priorities and preferences.

This framework is further anchored in Ipsos’ Spectrum of Necessity, which categorises purchases into three broad territories—Essential Commodities, Casual Indulgence, and Pleasurable Indulgence—highlighting how decision-making evolves based on context and mindset.

In Essential Commodities categories, brand importance remains relatively low, as purchases tend to be low-involvement and habit-driven. Functional considerations such as price and performance dominate decision-making. While familiar brands aid recall and signal reliability, they rarely drive active consideration. In such categories, Ipsos notes that brands must clearly communicate functional superiority and a compelling reason to buy. Strong visibility at the point of sale, supported by in-store promotions and clear functional messaging across touchpoints—including PoS, digital and social media—is critical. Distinctive packaging and widespread availability help simplify choice and maximise recall at the moment of decision.

As shoppers move into Casual Indulgence—everyday discretionary purchases—the influence of branding becomes more pronounced. Here, a strong brand acts as a shortcut to quality and reliability, accelerating the purchase process. Sensory cues, particularly flavour, play a significant emotional role in shaping preference and repeat purchase. Pack size and format gain importance, often reflecting consumption context. In on-the-go categories, portability and convenience drive pack relevance, while at-home categories rely on packaging that enhances usage occasions, experience and storage. Ipsos highlights that in these higher-involvement purchases, marketers must focus on informing and reassuring consumers, building trust through credible information and consistent brand presence.

In the realm of Pleasurable Indulgence—often associated with luxury—the brand itself becomes the primary driver of choice. These purchases are shaped by emotion, self-expression and aspiration rather than functional benefits. Marketing in this space extends beyond utility into storytelling, heritage and symbolism. Ipsos notes that indulgent purchases are frequently linked to celebration and self-reward, with limited editions, waitlists and curated experiences reinforcing scarcity, exclusivity and perceived value.

These insights underscore that the role of branding is not static but deeply context-dependent. “By recognising that the significance of a brand shifts across purchase occasions, marketers can more effectively allocate resources and craft messages that resonate with the consumer’s mindset in each specific context,” said Archana Gupta, Executive Director and Head of Shopper Insights, Ipsos India.

“The key is understanding whether the consumer is making a functional choice, a value-led decision, or an emotional investment in a story and identity,” she added.

Reinforcing this perspective, Shruti Patodia, Research Director, Ipsos Shopper Insights, said, “When marketers acknowledge that brand meaning evolves along the purchase spectrum, they are better equipped to design strategies that are informed, relevant, and impactful at every stage of the shopper journey.”