Bengaluru: Amagi Media Labs Limited, a Software-as-a-Service (SaaS) company in the media-tech space, has filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) to launch an initial public offering (IPO). The proposed offering comprises a fresh issue of equity shares worth up to ₹1,020 crores, along with an offer for sale (OFS) of up to 3.41 crore equity shares by existing shareholders.

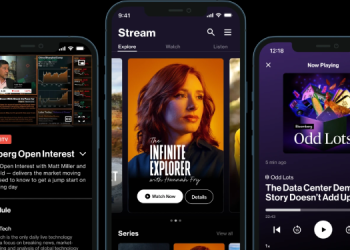

Amagi, founded in 2008 by Baskar Subramanian (Managing Director & CEO), Srividhya Srinivasan (Chief Technology Officer), and Arunachalam Srinivasan Karapattu (President – Global Business), is backed by marquee investors such as Accel, Avataar Ventures, Norwest Venture Partners, and Premji Invest. The company’s cloud-native platform enables media companies to distribute content seamlessly across smart TVs, smartphones, and streaming applications. It currently works with over 45% of the top 50 listed media and entertainment companies globally by revenue.

IPO Structure and Use of Proceeds

As per the DRHP, the IPO will include:

- Fresh issue of shares aggregating up to ₹1,020 crores

- Offer for Sale (OFS) of 3,41,88,542 equity shares by investor and individual shareholders

The Investor Selling Shareholders in the OFS include PI Opportunities Fund I, PI Opportunities Fund II, Norwest Venture Partners X – Mauritius, Accel India VI (Mauritius) Ltd., Accel Growth VI Holdings (Mauritius) Ltd., Trudy Holdings, AVP I Fund, and select individual investors.

Amagi plans to utilize ₹667 crores from the fresh issue towards investments in technology and cloud infrastructure, with additional funds earmarked for inorganic growth through acquisitions and general corporate purposes.

The company also stated that it may consider a Pre-IPO placement of up to ₹204 crores before filing the final RHP with the Registrar of Companies (ROC). If undertaken, the size of the fresh issue will be adjusted accordingly.

Amagi reported operating revenue of ₹1,162 crores in FY25, clocking a 30.7% CAGR between FY23 and FY25. The company also achieved a turnaround in profitability, with its adjusted EBITDA margin improving to 2.02% in FY25, compared to (17.69%) in FY24 and (20.62%) in FY23.

Amagi operates as a full-stack, AI-enabled cloud platform in the media & entertainment industry — a unique end-to-end “industry cloud” that supports three core verticals:

- Cloud Modernization

- Streaming Unification

- Monetization & Marketplace

These verticals serve a diverse customer base including:

- Content Providers (TV networks, movie studios, sports leagues, and more)

- Distributors (OTT platforms, telecom operators, and smart TV manufacturers)

- Advertisers and Ad Platforms (DSPs, agencies, and digital ad tech providers)

Kotak Mahindra Capital, Citigroup Global Markets India, Goldman Sachs (India) Securities, IIFL Capital, and Avendus Capital are acting as the Book Running Lead Managers (BRLMs) for the IPO. The company’s equity shares are proposed to be listed on the BSE and NSE.