Companies create value for their shareholders by investing cash now and creating value in the future. The amount of value created is the difference between cash inflows and the cost of investments made, adjusted to reflect the time value of money.

The key variable to determine the value of a company is primarily Growth, Revenue, and Return on Invested Capital (ROIC). In simple terms, the ability of any firm to create value will be governed by ROIC and Growth and its sustainability.

The critical factor to make a note here is any company would create value only if the ROIC exceeds the cost of capital for any firm.

Value in a pure sense expected cash flows discounted at cost of capital, value creation is the changes in cash flows arising out of ROIC, revenue, &growth layered with the strategic direction which the firm wants to adopt.

Why is growth important? Investors want their money to compound with reasonable safety, managers want the opportunity to create something remarkable these two objectives converge on growth. Growth seemingly seeks to provide answers to both, but only if returns are in excess of the cost of capital.

Disaggregating cash flows into revenue, growth, and ROIC elucidates the underlying value drivers for a firm. If someone told you cash flows for Firm A increased from 100 Rupees to 150 Rupees, this doesn’t tell you anything, as an increase in cash flows can come from managing working capital, increased revenue growth, reducing capital expenditure.

In the same case of Firm A, if someone threw a little bit more information, where he told you that the company grew its revenue by 10% and earns a ROIC of 15%, now this makes more sense to evaluate the company in totality, as we can compare the companies of the same size, same industry and what is the growth rates in all other firms similar to Firm A and what is the cost of capital other firms operate on and many other things.

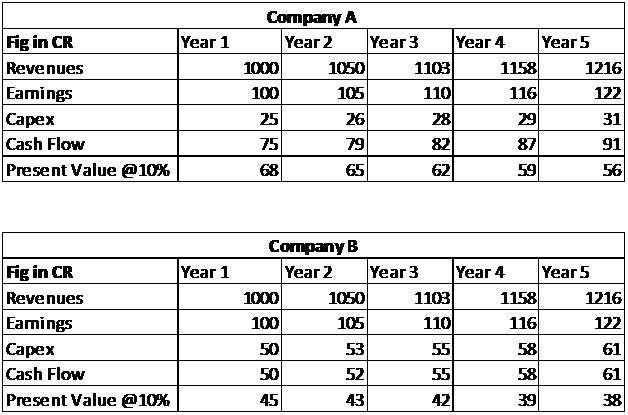

Growth, ROIC, and Cash flows are mathematically linked and have a huge impact on value. Let’s take a simple example to drive the point, let’s take 2 firms A&B operating in a similar industry and note that both companies earn 100 CR in Year 1 and increased revenues and earnings by 5% so projected earnings are identical. Now if the popular view of earnings is what drives value remains true, then both companies should have similar values. Let’s drive the point below and see if that matches.

Analyzing the 2 companies with similar growth rates and similar earnings but different cashflows due to CAPEX and thanks to Company A having a higher ROIC. Company A invested 25Cr out of the 100Cr earned in year 1 to increase profits by 5 Cr in year 2. Its return on capital is (5/25) which is ROIC of 20%, contrast that with Company B, where ROIC is (5/50) 10%.

The most vital point to note here is that Company B is creating zero value as the cost of capital for the firm is 10% and Company A is creating value by beating the cost of capital, hence chasing growth mindlessly is a fool’s errand. Mathematically Growth, ROIC and Cash flows (as represented as investment rate) are tied together, and let’s see below how.

Growth = ROIC x Investment Rate (Capex)

Applying the formula to Company A = 20% * 25% = 5%

Applying the formula to Company B = 10% *50% = 5%

From the above you can clearly see to achieve the same growth Company B needs a higher investment rate. Another way to look at the same in terms of cash flow:

Cashflow = Earnings x (1- Investment Rate) where Investment Rate = Growth/ ROIC.

So Cashflow= Earnings x (1- Growth / ROIC). Distilling that for the above 2 companies

Company A = 100 x (1-5% /20%) = 100 x (1-25%) = 75 Cr

Company B = 100 x (1-5%/10%) = 100 x (1-50%) = 50 Cr

Why is ROIC so important? Charlie Munger brilliantly put it “Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for that forty years, you’re not going to make much different than a six percent return – even if you originally buy it at a huge discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive looking price, you’ll end up with one hell of a result.

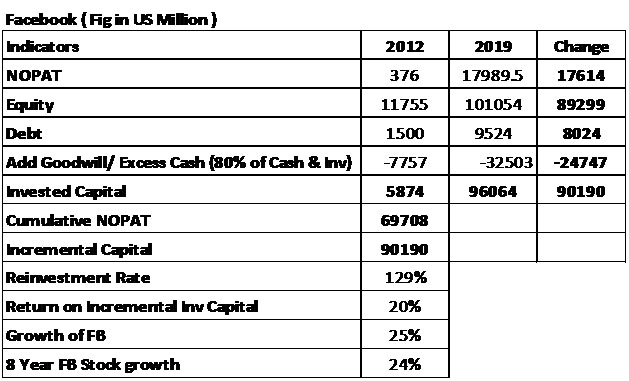

FB clearly resonates with what Munger has to say in any business. FB has a high reinvestment rate due to a long runway and it earns 20% on its incremental capital deployed leading to a compounding of 24% over a period of 8 years, when compared it is not very different from its incremental capital returns.

A business, in the long run, will eventually revert to the incremental capital returns, and any business which cannot compound capital at high rates will display lackluster performance in the capital market. In fact, this applies to any asset, hence ROIC, Cashflows, and Revenues are mathematically tied and drive the value of the firm.

To Quote Munger

Our experience tends to confirm a long-held notion that being prepared, on a few occasions in a lifetime, to act promptly in scale, in doing some simple and logical thing, will often dramatically improve the financial results of that lifetime.

We would like to conclude by stating that if you find any business which generates high incremental capital, has a long runway, and is devoid of any fraudulent practices, and is available at a sensible price, the approach is to bet huge and not go out with mugs but with buckets to buy the business.

This article is authored by Tanvi Mehta, Ramaswamy Ranganathan, and Sudarshan R, who are value investors and also teach the craft of valuation in leading Business Schools”