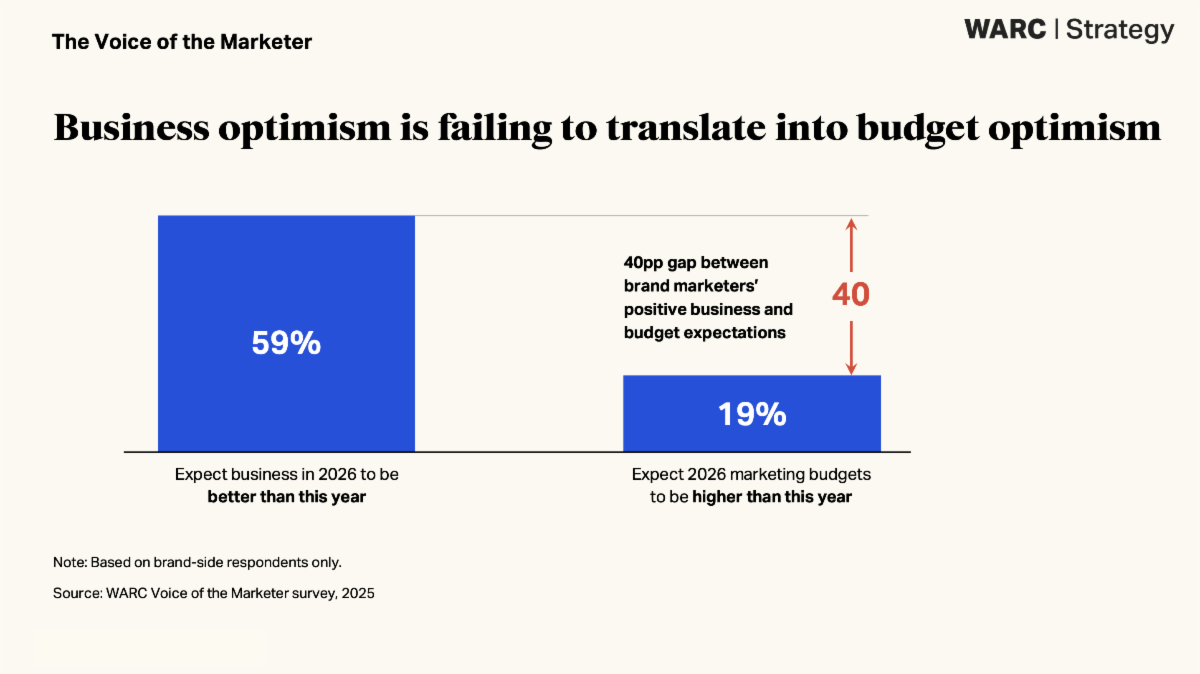

Mumbai: Marketers are heading into 2026 with a cautious mindset, as new insights from WARC’s Voice of the Marketer report reveal a widening gap between business optimism and marketing budget expectations. While 59% of brand marketers believe business will improve next year, only 19% expect marketing budgets to rise, highlighting the continuing challenge of doing more with less.

Part of WARC’s Evolution of Marketing programme, the report draws on a global survey of 1,000+ marketers conducted between September and October 2025 and explores the themes shaping the industry in the year ahead.

Stephanie Siew, Senior Research Executive, WARC, said, “Despite the decline in marketer optimism, it’s worth pointing out that the majority of both brand and agency marketers (54%) still expect next year to be better than this one. However, budget expectations are a lot lower, which will heap more pressure on marketers in 2026.”

Aditya Kishore, Insight Director, WARC, added, “A significant red flag for marketers is the tension between poor macroeconomic visibility and the need to plan for long-term business growth — which is why more than half see short-termism as a major industry concern.”

Key Findings:

- Business vs Budget Optimism: 59% of brand marketers expect business growth in 2026, but only 19% anticipate higher marketing budgets. Those expecting tighter budgets are more likely to invest in performance marketing (42%) than brand marketing (29%).

- Short-termism Rising: Over half of marketers (55%) identify short-term focus as a key concern, up 30 percentage points from 25% in 2022.

- Economic Concerns: 61% of marketers cite economic conditions, including US trade policies and tariffs, as a key challenge for 2026. North American marketers feel the impact most acutely, with concerns over slowed investment, supply chain disruptions, and reduced margins.

- Scenario Planning and Agility: 40% of marketers are adopting scenario planning to model multiple economic outcomes and restructure teams to remain agile.

- AI Disruption: 59% of marketers express concern about AI disruption, more than double the 28% reported in 2023. Popular AI uses include summarizing large texts (76%), competitor analysis (74%), and customer insights (60%). Over a third (35%) fear AI could replace several human marketing functions within three years. Agencies (40%) feel the threat more acutely than brand marketers (30%), who are leveraging AI to scale more efficiently amid budget constraints.

Alex Craddock, Chief Marketing and Content Officer, Citi, said, “We’ve had a lot of uncertainty this year, which has caused volatility… Markets have proven to be pretty resilient up until now; at some stage, that resilience will start to wane.”

Lex Bradshaw-Zanger, Chief Marketing and Digital Officer, SAPMENA Zone for L’Oréal Groupe, said, “The new rule of engagement is strategic orchestration: knowing when to deploy AI, how to combine it with human insight, and maintaining control over your data and brand integrity while scaling at unprecedented levels.”

- Digital-First Media Investment: 90.3% of advertising dollars are projected to go to online-only platforms, with marketers prioritizing online video, influencer/creator marketing, and social media. Paid search spend is expected to grow to $274bn in 2026 but at a slower pace due to platform fragmentation. Retail media is seeing rising interest, though 28–29% of marketers still do not invest in this channel.

The Voice of the Marketer report complements WARC’s recently released Marketer’s Toolkit, which identifies five key trends set to disrupt global marketing strategies in 2026: the vanishing middle, the creator gamble, the great escape, the zero-click customer journey, and the reset of consumer milestones.

Both reports are part of WARC Strategy’s Evolution of Marketing programme, aimed at helping marketers navigate industry shifts, optimize budgets, and drive effective marketing outcomes.