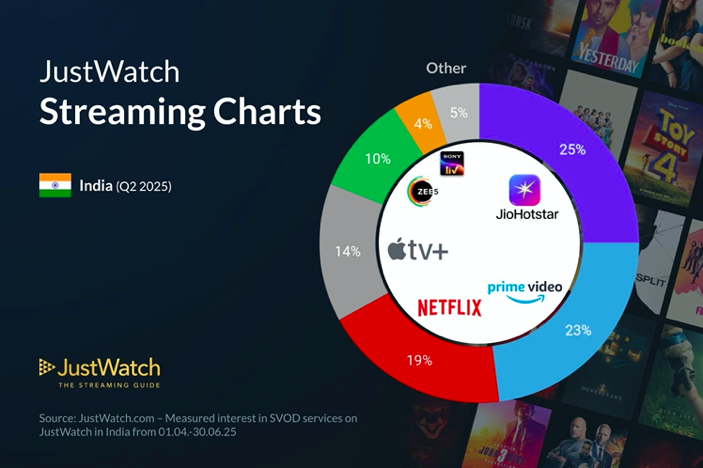

The Indian Subscription Video On Demand (SVOD) sector remained highly competitive in the second quarter of 2025, with JioHotstar consolidating its position as the market leader, according to the latest data from JustWatch, a global streaming guide and analytics platform. Covering the period from April 1 to June 30, 2025, the report highlights both stability at the top and shifts in the mid-tier segment.

Market Leaders Hold Ground

JioHotstar maintained its leadership with a 25% share, slightly down from the 26% recorded in Q1 when the newly merged JioHotstar (Disney+ Hotstar and JioCinema) had made a strong debut. Despite the minor dip, it continues to dominate India’s SVOD landscape.

Amazon Prime Video followed closely at 23%, showing only a marginal decline from its 24% in Q1. The platform’s consistency underscores its entrenched user base and strong value proposition in India’s streaming ecosystem.

Netflix Strengthens Position

Netflix registered a notable rise, climbing to 19% in Q2 from 17% in Q1. This 2% gain signals growing momentum for the global giant, which has been intensifying local content investments to better resonate with Indian audiences.

Apple TV+ Gains Traction

Apple TV+ delivered a strong performance, growing its share from 12% in Q1 to 14% in Q2. This upward trajectory reflects its appeal among premium audiences and the increasing relevance of its content slate in India’s crowded market.

Regional & Mid-Tier Platforms

ZEE5, once considered a challenger to the top three, slipped from 11% in Q1 to 10% in Q2, reflecting its struggle to keep pace with global players despite its regional strength. Sony LIV improved its share to 5% in Q2, up from 3% in Q1, indicating steady but modest growth.

Smaller Platforms Decline

Other platforms collectively accounted for just 4% in Q2, down from 7% in Q1. This contraction highlights increasing consolidation in the Indian streaming landscape, where major platforms are steadily capturing more audience attention.

Key Takeaways

The Q2 2025 SVOD market data underscores a three-way battle among JioHotstar, Amazon Prime Video, and Netflix, which together account for nearly two-thirds of the market. Apple TV+ continues to emerge as a credible challenger, while ZEE5 and Sony LIV are holding on to niche segments. The decline in “others” indicates waning space for smaller, standalone services as competition intensifies.

The Indian SVOD market from January to June 2025 highlights a clear consolidation around the top three players—JioHotstar, Amazon Prime Video, and Netflix—who together command nearly two-thirds of the market. JioHotstar retained its leadership despite a slight dip in share, while Amazon Prime Video maintained stability without significant growth. Netflix, however, showed the strongest upward momentum, climbing two percentage points to solidify its position as the third-largest player. Among mid-tier platforms, Apple TV+ emerged as the standout performer, gaining traction with a two-point rise, signaling increasing acceptance among premium viewers. In contrast, ZEE5 slipped marginally, reflecting challenges in holding its ground against global competitors, while Sony LIV showed modest improvement, inching up by two points. Smaller players, grouped under “Others,” faced a sharp decline, underscoring the difficulty niche platforms face in sustaining relevance in a market increasingly dominated by major streaming services.

As India’s streaming market matures, the coming quarters will likely see further consolidation, with local and global platforms doubling down on content investments, pricing innovations, and user engagement strategies on the backdrop of the on-going festival season.