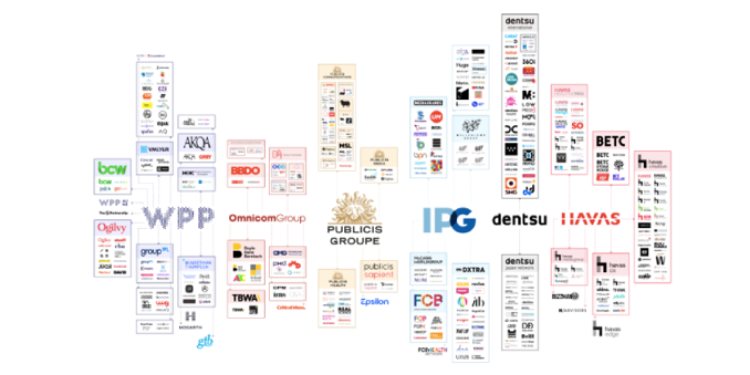

2025 will be remembered as the year the global advertising agency ecosystem stopped evolving gradually and changed structurally. Long-standing networks were dismantled, century-old brands disappeared, and holding companies rewired themselves to survive a world driven by scale, AI, and integration rather than legacy.

What played out across the year was not tactical restructuring but a fundamental rethink of how agencies are organised, sold, and valued.

WPP’s Creative Reckoning: One Network to Rule Them All

The clearest signal of this reset came from WPP, which completed its long-anticipated consolidation of creative agencies under a single global brand: VML.

By fully centralising its creative firepower within VML, WPP effectively closed the chapter on the multi-network creative model that once defined the holding-company era. Creativity, CX, commerce, data and technology were no longer housed in parallel brands competing internally, but fused into one platform designed for global scalability and operational efficiency.

The End of JWT

The most emotionally charged casualty of this move was JWT. One of the oldest and most influential agencies in advertising history, JWT’s final absorption into VML marked the symbolic end of heritage-led agency identity. Its shutdown sent a clear message across the industry: history is no longer a strategic moat.

Media’s Big Bang: GroupM Is Dead, Long Live WPP Media

WPP’s media transformation was even more disruptive. In 2025, the company formally retired the GroupM brand and launched WPP Media, collapsing its media agencies into a single operating entity.

This shift dissolved the independent identities of Wavemaker, MediaCom, Essence, Motivator and others, bringing them under one leadership structure, unified P&L, shared technology stack and centralised decision-making. What once operated as a portfolio of competing media brands became a single integrated buying and planning engine.

For clients, the promise was simplicity and scale. For the industry, it marked the end of an era in which media agencies differentiated primarily through brand names rather than systems and outcomes.

Omnicom–IPG: The Merger That Triggered the Great Agency Extinction

The year’s most dramatic shockwave came from the merger of Omnicom and Interpublic Group, creating the world’s largest advertising holding company and unleashing an aggressive consolidation phase.

In the months following the merger, some of the most iconic creative agency brands in the world were either retired or absorbed. Names such as DDB, FCB and MullenLowe—once pillars of global advertising—ceased to exist as standalone networks, folded into fewer, larger creative platforms like BBDO, TBWA and McCann.

This rationalisation extended into media as well, where overlapping Omnicom and IPG assets were merged, downsized or quietly wound up. Several specialist media brands found themselves operating under temporary structures, with their long-term futures uncertain.

Beyond brand closures, the merger accelerated job losses, heightened client conflict concerns and triggered account realignments across markets, particularly in APAC and India.

Havas: The Contrarian Growth Story of 2025

While rivals focused on pruning and consolidation, Havas emerged as the industry’s most bullish player.

Throughout 2025, Havas pursued an aggressive acquisition strategy across Europe, North America, Australia, and Asia, strengthening capabilities in CX, performance marketing, data, experiential and strategic communications. Its Converged.AI operating model gained traction, helping the network post strong momentum in APAC and India, where it added new regional and global clients.

By year-end, Havas was widely seen as the only major holding company expanding with intent rather than retrenching.

Speculation naturally followed. Industry chatter pointed to early-stage conversations between Havas and WPP around a possible global alignment, while closer to home, markets buzzed with talk of a potential partnership or merger between Havas and Madison World, which would combine international scale with Indian entrepreneurial depth.

dentsu: Asset Sales and Strategic Uncertainty

In contrast, Dentsu spent much of 2025 under a strategic cloud. Reports of the group exploring buyers for its international business were accompanied by the sale of real-estate assets, with profits booked to strengthen its balance sheet.

While dentsu remains dominant in Japan, its international posture through 2025 reflected caution rather than expansion, positioning it as a potential consolidation target rather than an aggressor.

Clients Are Already Reacting

The consequences of this consolidation wave are already visible in client behaviour. Late in the year, Jaguar Land Rover moved its global creative business from Publicis Groupe to WPP, a move closely watched across the industry.

The shift underscored the growing dilemma facing marketers: whether to embrace the efficiency and scale of consolidated networks or to worry about conflicts, concentration risk and reduced diversity of thinking.

2026 Will Accelerate the Same Forces

If 2025 dismantled the old agency order, 2026 is set to accelerate the same forces—fewer brands, bigger platforms, deeper AI integration and sharper client scrutiny.

The global advertising industry has crossed a point of no return. Agency identities are no longer anchored in legendary names but in systems, data and delivery capability. As consolidation continues, the real test will be whether clients reward this new model—or begin actively seeking alternatives beyond the holding-company ecosystem.

One thing is clear: the agency business entering 2026 is fundamentally different from the one that entered 2025, and there is no going back.