Mumbai: After 18 successful seasons, the Indian Premier League (IPL) has cemented its position as one of the world’s premier sporting properties, delivering unmatched broadcast reach and commercial scale. As the league continues to evolve into a global commercial powerhouse, attention is now shifting toward how individual franchises can unlock and maximise their standalone enterprise value.

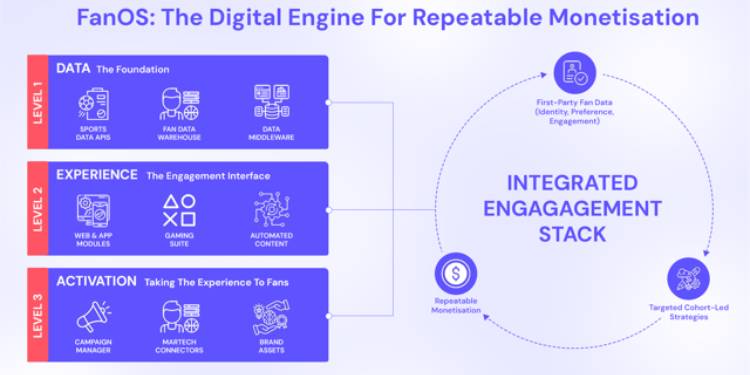

According to Sports Innovation (SI), the next phase of IPL franchise economics lies in reframing broadcast reach as the starting point of a longer value funnel—one that converts mass attention into sustained, owned relationships. Rather than viewing digital engagement purely as a marketing lever, franchises are being encouraged to treat it as a structured system for converting audiences into measurable, monetisable assets.

The report highlights that with the digital ecosystem rapidly evolving, the next media rights cycle is likely to focus on yield per fan rather than aggregate viewership alone. This signals a shift in fandom—from passive spectatorship to active participation. Franchises that build robust digital infrastructure capable of capturing first-party data, understanding fan behaviour, and activating personalised engagement strategies stand to create repeatable and scalable revenue streams.

Central to this transformation is the unification and operationalisation of first-party fan data—identity, preferences, engagement history, and transaction signals—collected through registrations and sign-ups. When leveraged effectively, this data can convert anonymous reach into known user bases, enabling segmentation, personalisation, improved retention, and higher lifetime value.

Without a structured digital engine, fan monetisation remains episodic and difficult to scale. However, with a well-integrated ecosystem, SI estimates that franchises could compound value of up to approximately ₹45 crore annually over time while simultaneously building long-term, high-quality fan relationships.

Decoding a ~₹50 Crore Annual Opportunity

The estimated ₹50 crore annual opportunity, SI notes, is not speculative but contingent on disciplined digital execution and maturity. It reflects the potential value franchises can unlock by treating fan relationships as long-term assets.

The projected opportunity is structured across four key pillars:

Data-led Sponsorship and Advertising Uplift (35% | ₹16–18 crore annually):

An ‘always-on’ data-driven engagement model across a 60–80 lakh first-party fan base can enable higher activation frequency and improved sponsor yield.

Direct-to-Fan Commerce and Experiences (30% | ₹11–14 crore annually):

Converting 5–7% of registered fans into buyers annually through curated, relevant and timely offerings could drive substantial incremental revenue.

Memberships and Recurring Fan Revenue (20% | ₹7–9 crore annually):

If 1–1.5% of fans enrol in tiered, year-round membership programs, franchises can generate recurring income through off-season engagement and loyalty initiatives.

Efficiency and Reinvestment Leverage (15% | ₹5–7 crore annually):

Automation, targeted communication, and improved operational yield can free up capital for reinvestment into core initiatives, strengthening long-term sustainability.

While the magnitude of opportunity will vary by franchise scale, geography, and execution capability, the broader direction remains clear: the future of IPL franchise economics will be shaped less by how many fans are reached and more by how many relationships are owned.

Note: These estimates stem from a detailed quantitative analysis of potential opportunities. They do not represent results already delivered to any franchise but reflect a realistic prospect as digital maturity advances across the ecosystem.