Mumbai: The global advertising market is poised to close 2025 with 8.9% growth, reaching US$1.19 trillion, according to the latest WARC Global Advertising Trends: Media’s New Normal report. The revised outlook marks an upgrade of 1.5 percentage points from WARC’s September forecast, fueled by the continued dominance of Big Tech platforms and minimal disruption from global trade tariffs.

WARC forecasts further acceleration in the coming years:

- 2026: Global ad spend expected to rise 9.1% to US$1.30 trillion

- 2027: A projected 7.9% increase will take total spend to US$1.40 trillion, double that of the pandemic-hit year 2020 and equivalent to US$150 per person globally

The report notes that structural shifts, rather than macroeconomic indicators, are now driving global ad growth.

Alex Brownsell, Head of Content, WARC Media, commented, “Advertising has broken away from the economic cycle, and behaves in a way that doesn’t feel reflective of the real economy. New money has arrived from digital-native categories, while commerce has redrawn the measured media map, and Big Tech’s self-reinforcing flywheel is harvesting almost all incremental dollars.”

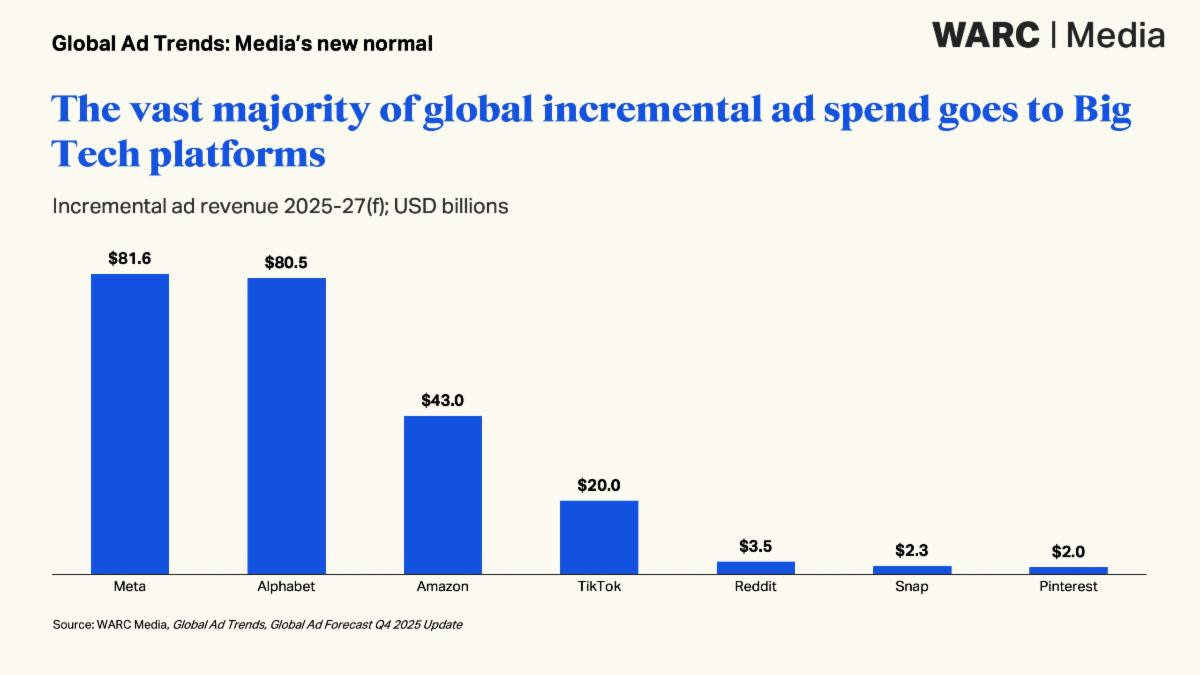

Big Tech Tightens Grip: Alphabet, Amazon & Meta to Hit 58.8% Share by 2027

The report reveals that Alphabet, Amazon, and Meta will command 56.1% of global ad spend excluding China in 2025—equivalent to US$556.6 billion. Their share is expected to rise to 58.0% in 2026, and 58.8% by 2027, with these platforms absorbing the vast majority of incremental global spend.

While emerging platforms such as TikTok and Reddit continue to grow, their scale remains significantly smaller. TikTok is projected to reach US$45.2 billion in ad revenue by 2027—still less than one-fifth of Meta’s projected revenues.

The consolidation is driven by Big Tech’s ability to reinvest at unmatched scale, especially in AI-driven optimisation, creative automation and first-party data infrastructure. Meta alone reinvests nearly 30% of its quarterly earnings in R&D.

Digital-Native Budgets Fuel Growth Despite Fragile Economic Indicators

While real wages stagnate and inflation pressures consumers, digital-first sectors continue to pour billions into measurable media channels such as search, social, and retail media.

Retail media now accounts for 14.7% of global ad spend.

A WARC survey of 1,093 marketers found that 51% expect to increase brand-building investment next year, despite weak consumer demand.

Global Market Outlook: US Leads, India Accelerates

- United States: Remains the world’s largest ad market with US$421.1bn in 2025 (35.3% of global share), projected to grow 7.0% in 2026 and 6.4% in 2027.

- China: Set for 6.9% growth in 2025 to US$200.1bn, accelerating to 8.9% in 2026.

- UK: Now the third-largest global market at US$58.1bn, growing 9.3% in 2025.

- India: Expected to rise 4.6% in 2025, accelerating to 8.0% in 2026 and 9.7% in 2027.

- Brazil, Germany, France, Spain, Italy, Japan also show stable multi-year growth driven by global sports events and rising digital investment.

A Market Entering a New Era

With ad spend increasingly decoupled from economic tides and consolidating within a handful of global platforms, WARC concludes that the industry is moving into a “new normal” defined by AI-enabled ecosystems, measurable media, and digital-native growth engines.