Global digital ad spend is under pressure from a silent threat: invalid traffic (IVT). A new report estimates that advertisers worldwide are expected to lose over $63 billion in 2025 to non-human clicks, fake impressions, and bot-driven engagement.

India is no’t spared. Even though the country’s invalid traffic rate is relatively low, just 5.5% compared to double-digit fraud rates elsewhere, the sheer size of its digital ad economy makes the loss impossible to ignore.

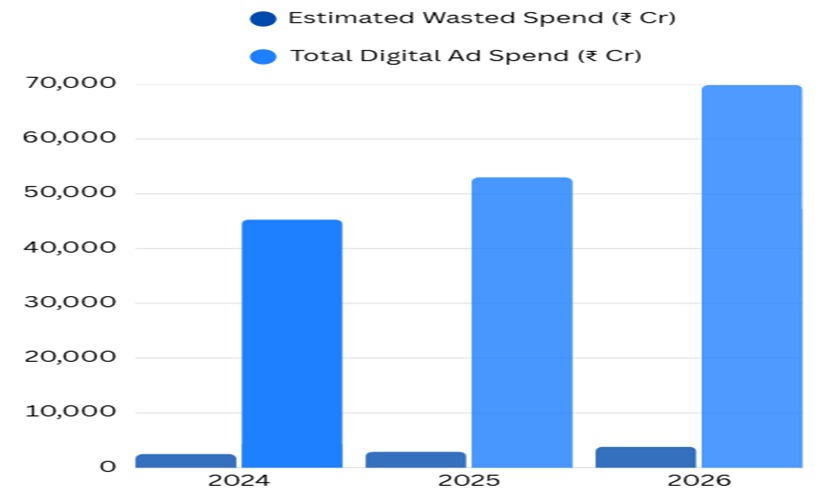

India’s digital ad spend hit ₹45,292 crore in 2024 and is projected to grow to ₹69,856 crore by 2026. At a 5.5% IVT rate, that translates to ₹2,500 to ₹3,800 crore in wasted spend every year, lost to bots, fake clicks, and synthetic user behavior that delivers no return.

What Is Invalid Traffic, and Why It Matters

Invalid traffic includes everything from bot clicks and duplicate impressions to fake installs and AI-driven synthetic user behavior. These aren’t just empty clicks, they distort analytics, pollute conversion models, and waste budgets on traffic that never had any real customer intent.

In simpler terms: every rupee spent on IVT delivers nothing back.

The Illusion of Safety

India’s 5.5% IVT rate looks good compared to China (16.4%) or Brazil (14.7%). But this can create a dangerous illusion. At India’s scale, ₹45,292 crore in 2024 rising to ₹69,856 crore by 2026, a 5.5% loss rate still means thousands of crores disappear annually.

To put it in perspective: the ₹2,500 crore lost in 2024 is larger than the full annual ad budgets of many top-tier brands.

The ₹45,000 Crore Leak, Sector by Sector

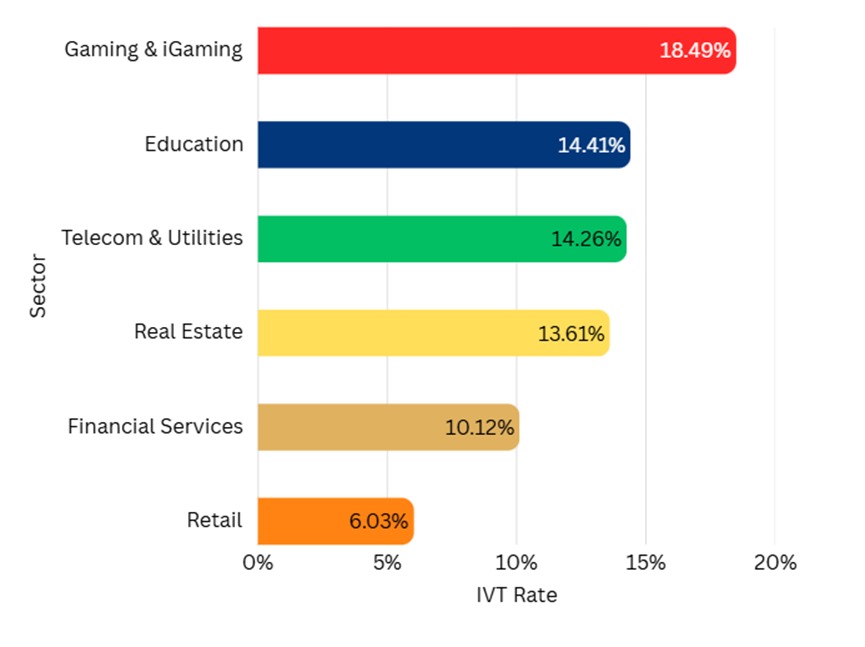

The IVT impact isn’t evenly distributed. Globally, certain sectors are much more vulnerable to ad fraud. Based on 2025 data:

- Gaming/iGaming: 18.49% IVT

- Education: 14.41%

- Telecom & Utilities: 14.26%

- Real Estate: 13.61%

- Retail: 6.03%

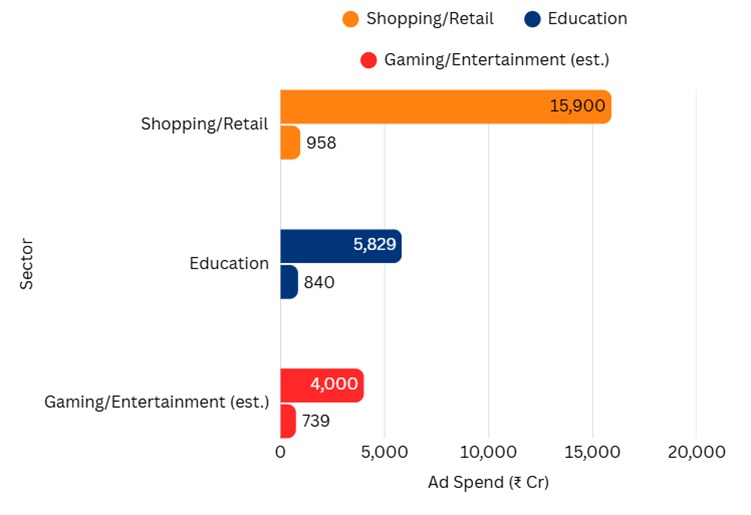

India’s sectoral ad spend breakdown (Sensor Tower, H1 2025):

- Retail/E-commerce: ₹15,900 crore (30% of total)

- Jobs & Education: ₹5,829 crore (11%)

- Gaming/Entertainment (estimated): ₹4,000 crore

Applying those fraud rates:

- Retail: ₹958 crore lost

- Education: ₹840 crore lost

- Gaming/Entertainment: ₹739 crore lost

Together, just these three segments account for more than ₹2,500 crore in wasted spend.

Platform Breakdown: Where Fraud Hides

Ad fraud also depends on where brands run their campaigns. According to the Lunio Invalid Traffic Report:

- TikTok: 24.2% IVT

- LinkedIn: 19.88%

- X (Twitter): 12.79%

- Meta (Facebook/Instagram): 8.2%

- Google Ads (overall): 7.57%

a) But Google Display: 12%+

b) Google Video Partners: 20%+

A ₹50 crore TikTok campaign could lose ₹12 crore. A ₹10 crore LinkedIn campaign? About ₹2 crore gone. And since platforms typically don’t disclose IVT openly, these losses rarely show up in campaign reports, they are simply counted as impressions delivered.

The Lead-Gen Trap

Lead-generation campaigns are especially vulnerable. Global data shows lead-gen ads suffer 32% more invalid traffic than ecommerce-focused campaigns. That puts pressure on India’s B2B, edtech, fintech, and insurance sectors.

A company might spend ₹100 crore expecting 1 million leads. But if 10–12% of that traffic is fake, they’re left with polluted CRMs, wasted sales effort, and skewed marketing forecasts.

What Makes India Uniquely Exposed

There are several reasons why this fraud is so persistent:

False confidence: India’s “low” fraud rate masks the scale of rupee losses.

Opaque reporting: Major platforms report IVT vaguely, if at all.

Sector blind spots: Retail and fintech have better fraud controls. But education, gaming, and lead-gen-heavy brands often operate with little detection.

Next-gen threats: AI bots now mimic real users, browsing sites, filling forms, clicking buttons, making detection even harder.

The Invisible Cost

Even the most conservative estimates show India’s brands are losing over ₹2,500 crore to ad fraud annually. As ad budgets grow to ₹70,000 crore and beyond, so will the size of the black hole.

This isn’t a marginal issue. It’s not about “outperforming global peers” or having “relatively low risk.” It’s a measurable economic loss, happening every quarter, across nearly every sector. And for now, it remains largely invisible.

(Views are personal)