Mumbai: The Indian Premier League (IPL) has reinforced its status as one of the world’s most valuable sporting properties, with a 12.9% surge in overall business enterprise value, now pegged at US$18.5 billion, according to the 2025 IPL Brand Valuation Study released by global investment bank Houlihan Lokey. The league’s standalone brand value has also witnessed robust growth, climbing 13.8% year-on-year to reach US$3.9 billion.

This sharp increase reflects the IPL’s growing global footprint, diversified revenue streams, and continued dominance across broadcast and digital platforms. The Board of Control for Cricket in India (BCCI) generated ₹1,485 crore from the sale of four associate sponsor slots—My11Circle, Angel One, RuPay, and CEAT—marking a 25% increase from the previous cycle. Adding to the league’s commercial momentum, the Tata Group renewed its title sponsorship through 2028 in a deal valued at ₹2,500 crore (US$300 million).

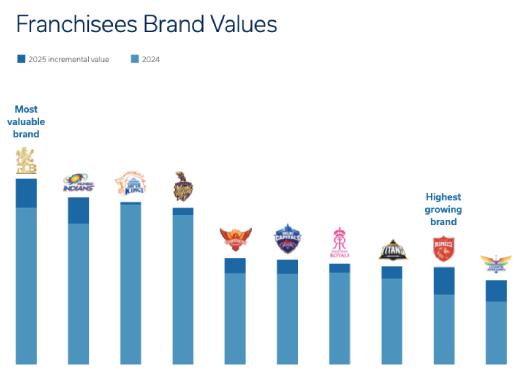

RCB Emerges as Top Franchise, PBKS Leads Growth Chart

In a major reshuffle of franchise brand rankings, first-time champions Royal Challengers Bengaluru (RCB) dethroned Chennai Super Kings (CSK) to become the most valuable IPL franchise. RCB’s brand value rose by 18.5% to touch US$269 million, surpassing Mumbai Indians (US$242 million) and CSK (US$235 million).

Punjab Kings (PBKS) stood out as the fastest-growing franchise, recording a staggering 39.6% year-on-year increase in brand value. Lucknow Super Giants also saw significant traction with a 34% rise.

“This growth is a testament to the league’s evolution into a mature media-sport ecosystem,” said Harsh Talikoti, Director, Financial and Valuation Advisory, Houlihan Lokey. “The IPL is no longer just a cricketing event; it’s a high-performing, diversified asset class that commands investor interest and drives global cricket commercialisation. Its success stems from OTT proliferation, a youthful demographic, and dynamic franchise models that blend entertainment with strategic asset creation.”

Record-Breaking Viewership

The 2025 IPL season shattered previous viewership records across both digital and linear platforms. JioHotstar clocked 1,370 million views during the opening weekend alone—a 35% YoY spike—with a peak concurrency of 340 million and over 21.8 billion minutes of watch time. Star Sports added another 253 million unique TV viewers, reflecting a 14% rise from the previous year.

The grand finale, which saw RCB clinch their maiden title against PBKS, became the most-watched cricket match ever streamed in India, drawing 67.8 crore views on JioHotstar—surpassing even the high-stakes India-Pakistan ICC Championship game earlier this year.

Speaking on the league’s commercial maturity, PBKS CEO Satish Menon noted, “We’ve moved beyond the mindset of a cricket team—we’re building a media-sport brand with multiple revenue verticals. The IPL offers a scalable business model that integrates sport, entertainment, and IP development. This holistic approach has enabled us to create long-term value that outlives a single season.”

The report underscores the IPL’s role as a pioneering model for modern sports leagues, merging athletic performance with high-yield business operations. With continued investments in women’s cricket, international expansion, and content-led monetisation strategies, the IPL is poised to remain a benchmark for global cricket commercialisation.

As the league deepens its presence across markets and platforms, the Houlihan Lokey report confirms what stakeholders have long known: the IPL isn’t just changing cricket—it’s redefining the global sports business landscape.

Royal Challengers Bengaluru (RCB)

RCB have replaced Chennai Super Kings to secure No. 1 in both brand and business value rankings, with a staggering brand value of US$269.0 million. RCB finally broke their title drought, clinching their maiden IPL in 2025, ending a 17-year wait. This was achieved through a perfect balance of continuity and reinvention, including appointing Rajat Patidar as captain while retaining Virat Kohli as a senior batter.

Mumbai Indians (MI)

Mumbai Indians (MI), another immensely successful and popular team, ranked No. 2 with a brand value of US$242.0 million. In 2025, MI upheld its reputation as a premier brand, and its on-field consistency reflected a strong strategy. MI’s brand equity remains robust, driven by its legacy, charisma, and continued relevance, even with Rohit Sharma embracing a new role as an impact player.

Chennai Super Kings (CSK)

Due to a disappointing season on the field, Chennai Super Kings (CSK) slipped to No. 3 in terms of brand value with US$235.0 million, compared with their No. 1 ranking last year, achieving a growth of 1.7% from the previous year. The 2025 season saw an unexpected mid-season leadership change with Ruturaj Gaikwad’s injury, leading to Mahendra Singh Dhoni resuming captaincy to stabilise the squad. Despite struggling throughout the campaign and ultimately finishing at the bottom of the points table, Dhoni’s influence remained undeniable as the franchise began a clear rebuilding phase.

Kolkata Knight Riders (KKR)

Kolkata Knight Riders (KKR), which won the 2024 IPL season, secured the fourth place in brand value with US$227 million. KKR capitalises greatly on the brand equity of its renowned owner, Shah Rukh Khan, along with standout players like Sunil Narine, Rinku Singh, Andre Russell, and Varun Chakravarthy. Notably, KKR bid farewell to Shreyas Iyer, which proved detrimental to its performance.

Sunrisers Hyderabad (SRH)

With a brand value of US$154.0 million, Sunrisers Hyderabad (SRH) stands fifth on the list. Following their runner-up finish in the 2024 season, SRH entered 2025 with high expectations, particularly given their explosive batting lineup featuring Heinrich Klaasen, Travis Head, Abhishek Sharma, and the addition of Ishan Kishan. Many anticipated SRH to cross the 300-run mark and go all the way consistently. However, despite their strong squad, the season saw some on-field inconsistency, and these challenges impacted the broader momentum of the team.

Among the rest of the teams, Delhi Capitals (DC), ranked sixth with a brand value of US$152.0 million. Rajasthan Royals (RR) ranked seventh with US$146.0 million, with young talent Vaibhav Suryavanshi keeping fan engagement high. Gujarat Titans (GT) secured eighth place with US$142.0 million. PBKS achieved the highest growth of 39.6%, reaching US$141.0 million and ranking ninth, largely due to their strong performance as runners-up under new captain Shreyas Iyer, and Lucknow Super Giants, at 10th, has a brand value of US$122.0 million.