Author: Vincent Letang, EVP, Managing Partner, Global Market Intelligence

- Media Owner Linear Advertising Sales to Decrease by -16% Globally Amidst Global Recession While Digital Ad Sales Will Slow Down (+1%).

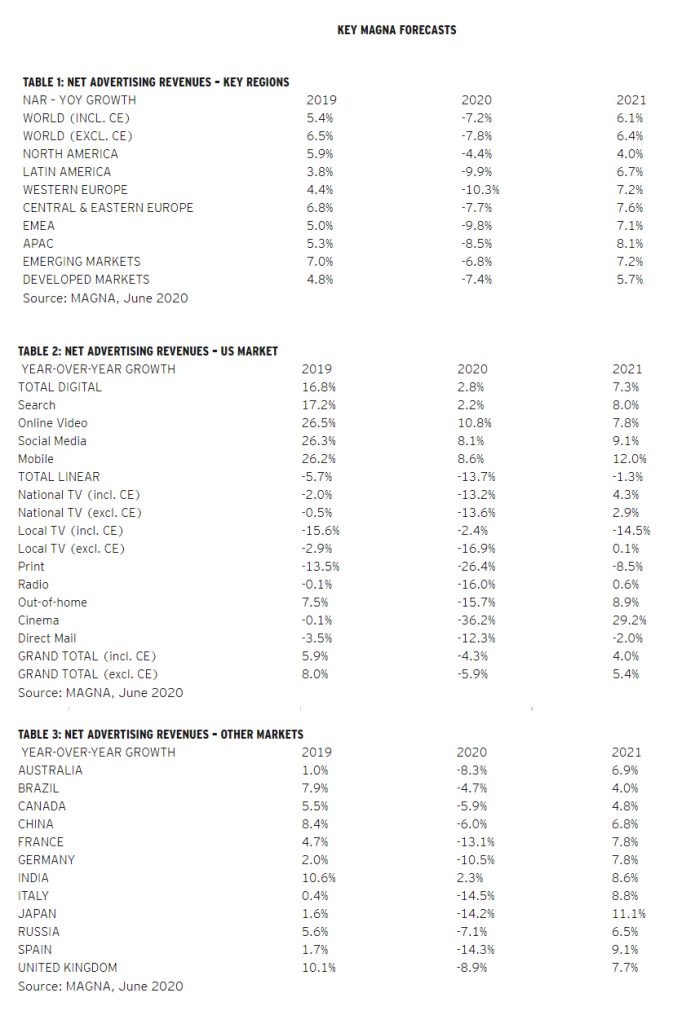

- Total Media Owner Advertising Revenues (Linear + Digital Formats) to Shrink by $42 billion (-7.2%) in 2020, Before Recovering +6.1% in 2021.

- EMEA Fares Worse than Other Regions with Total Advertising Down -10% and Up to -14% in Southern Europe.

- US Market Shrinks by -4% as Political Ad Sales ($5 billion) and Digital Media Resilience (+3%) Mitigate the Decline of Linear Sales (-17% Excl. Political).

- Beyond the 2020 Economic Recession, the COVID Crisis Will Have Lasting Effects on Consumption, Business Models and Marketing Expenditure.

GLOBAL MARKET PLACE: -7% IN 2020

- Media owners’ advertising revenues will decrease by $42 billion in 2020, from $582 billion to $540 billion, as advertising spending shrinks due to the severe economic recession triggered by the COVID-19 pandemic, as GDP is expected to contract between -5% and -12% across the world’s largest markets. Global advertising revenues will decrease by an estimated -7%, as the heavy, double-digit decline of linear ad sales (linear TV, print, linear radio, OOH, cinema), -16% to $238 billion, will be mitigated by the stability of digital formats: +1% to $302 billion.

- Linear television ad revenues will shrink by -12% this year, due to the weakness of demand, the cancellation of many TV campaigns and the postponement of major sports events. Print ad sales will decline by -32% while linear radio advertising revenues will decrease by -15%. Out-of-home, the most dynamic linear media channel pre-COVID is hurt by the dramatic decline in traffic and audience, in addition to the fall in demand from local and national advertisers. Global OOH ad sales are expected to decline by -22%, with the transit segment experiencing even deeper decreases. Finally, theater closures will cause cinema advertising to decline by -40% this year.

- Digital formats advertising sales (search, video, social, banners) are expected to be flat (+1% at $302 billion) as a second half recovery will offset the first half decline. Digital formats benefit from increased digital media usage during lockdown, an acceleration of e-commerce that will likely outlive the lockdown, and a boost to lower-funnel marketing tools that is classic in recession times. Search will remain the largest digital advertising formats ($142 billion) but global sales will stagnate (-1%). Social media and digital ad formats will slow down from previous years but still grow single-digit this year (both +8%) while the revenues of static banner ads will fall by -11% as the COVID crisis adds to the increasing restrictions on data-based targeting.

- As the pandemic and economic crisis is global, so is the impact on the advertising market. EMEA and Latin America will experience the worst downturn, with total advertising revenues down -10%, with APAC marginally more resilient (-8.5%). North America may show more stability, partly due to the $5 billion that will be spent around the 2020 election cycle (see more details on the US market in the US section of this summary). Among the worst downturns predicted by MAGNA in 2020, among large markets, Japan and Spain (both -14%), France (-13%) and Italy (-15%). India (+2%), China (-6%) and the US market (-4%) will be less dramatically affected.

- The 2Q lockdown has prompted some dramatic changes in media consumption. Linear TV viewing increased by 10% to 40% during lockdown but MAGNA anticipates a return to long-term erosion in the second half. Streaming video, SVOD and OTT consumption also accelerated further during lockdown. The impact on audio media varied by market but radio struggles where car commuting represents a large part of daily audience. Finally, OOH suffers from driving mobility and transit mobility down -60 to -80% in North America and Europe in 2Q and only the former showing significant recovery by June.

- In 2021, the global economy recovers (real GDP +5.8% according to the IMF) and major sports events (Summer Olympics, UEFA Football Championship in Europe) will fuel a recovery in marketing budgets and advertising spending. MAGNA predicts global ad spend to grow by +6.1% to $573 billion (EMEA: +7.1%, APAC: +8.1%, LATAM: +6.7%, NA: +4.0%). Despite the forecast recovery, the global market place will remain $9 billion smaller than its pre-COVID level.

Vincent Létang, EVP Global Market Intelligence at MAGNA and author of the report, said: “Beyond the short-term V-shaped recession/recovery impact on the economy and the advertising market, the COVID crisis will have global and long-term effects on society, business models, consumption habits, mobility, and media usage, all factors pointing to a more subdued economic growth and advertising spend than previously forecast for the 2022-2024 period. MAGNA thus reduces its global advertising growth forecast for these three years, from +4.5% per year to +3.5% year. The global ad market will reach $647 billion by 2021 compared to $745 billion in our previous long-term scenario (a -14% decrease)”.

US MARKET: -13% FOR LINEAR MEDIA IN 2020

- Total media owners advertising revenues (NAR) (linear+digital) will fall -4.3% to $213 billion in 2020, as the COVID pandemic leads to the worst economic downturn ever. Real GDP is expected to shrink by at least -6% full year, while household consumption falls, and unemployment rises. Excluding the $5 billion of incremental revenues from political advertising spending from the 2020 election cycle, non-political advertising revenues would actually drop -5.9% vs 2019.

- Linear advertising sales (linear TV, radio, print, OOH) will suffer the most, with full-year sales declining by -13% to $83 billion. Excluding linear political ad revenues (approx. $4bn) the actual decline of linear ad sales would be closer to -17%. The economic shutdown has not only cut down marketing activity from national brands and local businesses, but has also affected media consumption for print, radio and out of home. Linear television experienced a surge in consumption for about eight weeks but viewing levels were mostly back to normal by early June.

- In contrast with most linear media, digital advertising formats benefit from increased consumption, and will remain more resilient to the drop in advertisers demand. MAGNA anticipates ad spend on digital formats (search, video, social, banners, digital audio) to stabilize in the summer and recover in the second half, generating stability or modest growth on a full year basis (+2% to $130 billion). The most resilient formats will be digital video, expected to grow +10%, as well as social media formats (+7%), as suggested by the better-than-expected revenue trends published by Google and Facebook in 1Q20 financials. These growth rates still represent a significant slowdown compared to the double-digit growth rates of previous years, and the dollar stability reflects the fact that digital ad formats continue to gain market share during this recession.

- Advertising revenues still posted a +3.5% gain in the first quarter of 2020 (+2% excluding cyclical events), despite obvious deterioration in March. Digital video, social media and search drove spending growth in the quarter, with performances of +19%, +17% and +12%, respectively. Also of note was the nearly +5% increase in out of home media, as the billboard segment more than offset declines in the transit and street furniture segments in March. National television advertising sales dropped -8% in the quarter, which MAGNA believes was the result of January-February being flat and March being down -22% as the COVID lockdown led to many campaigns being cancelled or postponed.

- However, advertising sales are expected to post a precipitous decline in the second quarter: -17%. Many media formats will post substantial declines. National television ad revenues will fall -24%. Local television, radio, and print will see revenue declines of -30%, -34%, and -40% respectively. Out of home will be hit by the double-whammy of falling demand and falling audience as car traffic and public transit usage have fallen by 50% to 80% across the nation. OOH sales may decline by up to -44%. But the worst impact will be for cinema advertising with almost zero revenue during the quarter as theaters only start to reopen in the second half of June and all major movie releases have been postponed to 3Q and 4Q.

- With the gradual relaxation of lockdown measures throughout the US, MAGNA expects advertising spending to start to stabilize in 3Q (-5% vs 3Q19) and recover in 4Q (flat vs 4Q19) as some businesses that started reopening in May-June will need to rebuild market shares, traffic and sales in the coming months. Assuming an economic stabilization does take place in the second half, MAGNA expects national TV full-year advertising revenues to shrink by -13%. Local TV non-political ad revenues will decrease by -17% as key local TV verticals like auto dealers are severely affected by the downturn. With an expected $3 billion in incremental political revenues, total local TV ad sales will only decline by -2.4% (vs +10% to +20% in a normal election year). Print ad sales will shrink by 26% and radio ad revenues by -17%. OOH ad revenues will decrease by -17.5% and cinema ad sales by 36%. Finally, direct mail ad revenues will shrink by -12% as political revenues (half a billion dollars, +8% vs 2016) will mitigate the decline of non-political revenues (-15%).

- The economy shrank by -5% in the first quarter of 2020 (at an annualized rate) and is expected to contract by as much as -32% in the second quarter. The lockdown has caused personal consumption to plummet: retail sales fell -16% in April. Some sectors of consumption have been less affected by the lockdown as consumers’ use of ecommerce and local delivery exploded (food, drinks, toiletries, technology, etc.) but local services and goods relying on brick-and-mortar distribution have seen a collapse in sales during lockdown, car sales and clothing sales were down -50% and -90% in April, respectively.

- Many industries face significant economic headwinds and have been forced to cut considerable amounts of spend as a result. The travel, entertainment, automotive and restaurant industries will be among the most affected, and MAGNA expects each of these industries to reduce linear advertising spend by -25% or more on a full year basis. Conversely, pharmaceutical and food & beverage industries should remain relatively unscathed and will see their linear advertising spend reduced by single digits while certain segments in the technology industry (hardware, software, ecommerce) may even benefit from increased demand.

- The 2020 election cycle will generate $4.8bn in net incremental advertising sales, +24% compared to 2016 and a new all-time high. This will significantly mitigate the decline of advertising revenues in 2020. MAGNA reduces its previous growth forecast as fundraising from businesses and small donors will be affected by the recession but the massive spending in the first quarter and enormous war chests currently being amassed by Super PACs from large donors should still generate some growth vs four years ago. All media channels will benefit to a degree but digital media (social, video, search, in that order) will grow the most, to approach one billion dollars in political ad revenues this year for the first time.

- In 2021, MAGNA expects US advertising sales to rebound, posting a gain of +4.0% (+5.5% excluding cyclical events). However, with a total of $222 billion, the US ad market will still be slightly smaller than it was in 2019 ($223bn). The ad market will benefit from economic stabilization (GDP expected to grow between +3% – Philadelphia Fed – and +4.7% – IMF) and the Tokyo Olympic Games (approx. $800 million of incremental ad revenues). Linear advertising sales will stabilize (+1.5%) while digital ad sales will re-accelerate (+8%).