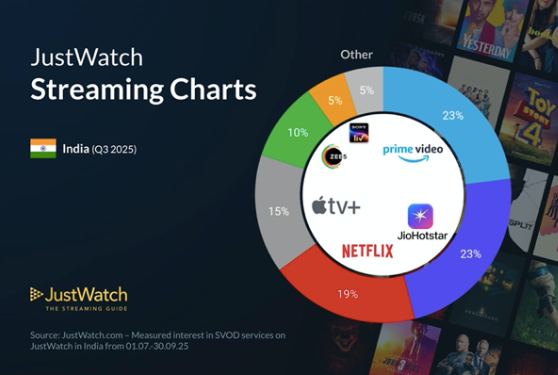

Mumbai: India’s OTT landscape underwent a notable reordering in the third quarter of 2025, with new JustWatch data indicating a far more stable and competitive hierarchy than the sports-inflated dynamics of the previous quarter. Q3 2025 places Prime Video and JioHotstar in a dead heat at 23% each, signalling a recalibration of viewer interest as the market moved away from the cricket-driven surge that had defined Q2.

Q3 2025: A Clearer, More Balanced SVOD Hierarchy Emerges

The Q3 charts offer a more accurate reflection of India’s streaming preferences. With both Prime Video and JioHotstar capturing 23% of user interest, the quarter underscores the formation of a dual leadership structure. Netflix maintains a steady 19%, reflecting strong urban engagement but limited expansion beyond its core. Apple TV+ continues its upward momentum, climbing to 15% and consolidating its position as the most influential mid-tier platform in the country. Zee5 and Sony LIV register stable but modest interest at 10% and 5% respectively, while niche platforms collectively hold 5%.

In contrast to this more evenly distributed interest in Q3, Q2 data had presented a skewed picture. JioHotstar had surged to 25% in that period, largely on the back of peak-season cricket consumption, while Prime Video held steady at 23%. Netflix remained unchanged at 19% across both quarters, and Apple TV+ moved from 14% in Q2 to 15% in Q3. Sony LIV showed a marginal improvement from 4% to 5%, while Zee5 and smaller platforms remained consistent. The shift from Q2 to Q3 reflects the cooling effect that follows India’s intensive sports windows and reveals the underlying competitive contours that emerge when seasonal volatility subsides.

A Rebalanced Streaming Market: The Significance of Q3’s Normalisation

Q3’s data signals a return to baseline viewing behaviour. JioHotstar’s decline from 25% in Q2 to 23% in Q3 suggests that while sports remain a powerful magnet for short-term engagement, the platform’s broader catalogue and bundling strength remain critical to sustaining long-term interest. Prime Video’s steady performance across both quarters highlights the platform’s non-seasonal appeal driven by a mix of global titles, expanding Indian originals, and the inherent stickiness of its bundled Amazon Prime ecosystem.

Netflix’s steady 19% across both quarters reflects a market position that is robust but not rapidly expanding. The platform continues to command loyalty among premium users, yet its absence from the sports category and selective approach to mainstream Indian content limits its ability to compete for incremental share. Apple TV+’s rise is one of the most notable trends across the two quarters. Its progression from 14% to 15% signals the emergence of a premium, prestige-oriented audience segment in India, one that increasingly responds to the platform’s global high-production-value storytelling even with a smaller library and fewer local offerings.

Regional and genre-focused platforms such as Zee5 and Sony LIV continue to maintain their established niches, but the absence of meaningful growth across both quarters suggests that the market is consolidating around a core group of four dominant players. Collectively, Prime Video, JioHotstar, Netflix and Apple TV+ account for more than 80% of user interest in Q3, reinforcing the notion that India’s streaming market is moving towards a more centralised competitive structure.

The Strategic Meaning of Q3’s Leadership Tie

The Q3 tie between Prime Video and JioHotstar is particularly significant. It signals that India’s OTT leadership is no longer determined solely by the intensity of seasonal sports windows. Instead, it reflects a deeper contest shaped by ecosystem economics, catalogue depth, pricing models and regional penetration. Prime Video’s ability to match JioHotstar post-cricket season indicates broader platform resilience, while JioHotstar’s sustained 23% demonstrates that its integration of sports, mass entertainment and telecom bundling has created a strong year-round value proposition.

For Netflix, the consistency in share highlights stable brand equity but also presents a strategic challenge. Without additional levers such as sports or broader regional content volumes, maintaining momentum in an increasingly competitive market may prove difficult. Meanwhile, Apple TV+’s rise marks the strengthening of India’s premium streaming tier, suggesting that audience behaviour is fragmenting not only by language and format but also by content ethos and production sophistication.

Q3 Redefines India’s True Streaming Baseline

Taken together, the Q2–Q3 comparison reveals a market shifting towards equilibrium. Q2’s sports-driven inflation gave JioHotstar a temporary lead, but Q3 provides the more realistic competitive baseline—one where Prime Video and JioHotstar stand shoulder-to-shoulder, Netflix holds its ground, and Apple TV+ continues to grow faster than many expected. As India heads into the festive quarter and anticipates upcoming sports rights cycles, the Q3 numbers set the tone for a more strategic, less seasonal battle for dominance, centred on ecosystem power, differentiated content, and long-term consumer retention.