India’s print advertising sector recorded a marginal decline in volumes during the first half of 2025, with a 4% drop compared to the same period last year, according to the TAM AdEx Half-Yearly Report for January–June 2025. Despite the slowdown, the medium continued to attract heavy investments from education, automotive and services brands, highlighting its relevance in specific high-spend categories.

Education Tops, Auto Accelerates

The Education sector maintained its leadership with a 20% share of ad space, followed closely by Services (15%) and Auto (15%). Banking, finance, and investment (9%) along with retail (7%) rounded off the top five sectors. Education dominated the category mix as well, with Multiple Courses and Coaching/Competitive Exam Centres among the most advertised segments.

Automotive categories also showed resilience. Cars remained the top advertised category in H1 2025, while Two Wheelers and Electric Cars featured prominently among leading brands. Notably, Travel & Tourism emerged as a new entrant in the top 10 categories, reflecting a post-pandemic uptick in discretionary spending.

Maruti Suzuki, Allen Career Institute Lead the Pack

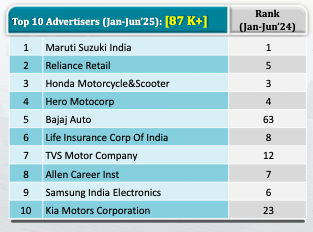

Among advertisers, Maruti Suzuki India retained its top spot, underscoring auto’s dominance in print. Reliance Retail, Honda Motorcycle & Scooter, Hero Motocorp, Bajaj Auto, and Life Insurance Corporation of India (LIC) were also in the top tier. Three new advertisers – Bajaj Auto, TVS Motor, and Kia Motors – broke into the top 10 list this year.

On the brand side, Allen Career Institute emerged as the single largest advertiser, followed by Honda Activa Range, Maruti Car Range, and Smart Bazaar. In fact, five of the top 10 brands were auto-linked, while education accounted for two.

Sales Promotions Drive Print Engagement

Sales-led messaging continued to be central to print strategies. Sales promotions accounted for 29% of all print ad space, with multiple promotions (47%) and discount offers (41%) dominating. This indicates that brands continue to use print as a high-impact medium for retail-driven campaigns and festive offers.

Language Split: Hindi and English Dominate

In terms of publication language, Hindi (37%) and English (27%) together contributed more than 60% of total ad volumes. Marathi (8%), Kannada (6%), Telugu (5%), and Tamil (6%) followed, reflecting the continuing strength of regional markets alongside national reach.

Growth Pockets Despite Decline

While overall volumes shrank, several categories recorded sharp growth. Departmental stores (+52%), branded jewellery (+46%), and travel & tourism (+29%) were among the fastest-growing segments. This suggests that retail and lifestyle categories are increasingly leveraging print to capture consumer attention during peak seasons.

Though print ad volumes softened in H1 2025, the medium continues to deliver strong value in education, auto, and retail-driven categories. The rise of promotions, new retail entrants, and resilience of regional publications signal that print remains an important part of India’s advertising mix—even as digital gains pace.