Mumbai: The global advertising market has received its first outlook upgrade in more than a year, with spend now forecast to rise 7.4% in 2025 to $1.17 trillion, according to WARC’s latest Global Ad Forecast Q3 2025 update. The revision, up 1.2 percentage points from June, comes on the back of an exceptional second-quarter windfall for social media platforms.

Growth momentum is set to continue, with 8.1% expansion expected in 2026, taking the market to $1.27 trillion, while a further 7.1% rise in 2027 would lift spend to $1.36 trillion – double the pandemic-hit total of 2020.

James McDonald, Director of Data, Intelligence & Forecasting at WARC, and author of the report, said, “Global ad spend is growing rapidly, with digital-first platforms capturing almost all the new money. Despite economic headwinds, including disruption to global trade and reduced purchasing power among consumers, brands are doubling down on Meta, Alphabet and Amazon, while emerging players like TikTok are growing fast but from smaller bases. The global market is set to nearly double in value since the pandemic, underscoring the resilience of advertising in a tougher economic climate.”

Social Media Drives Growth

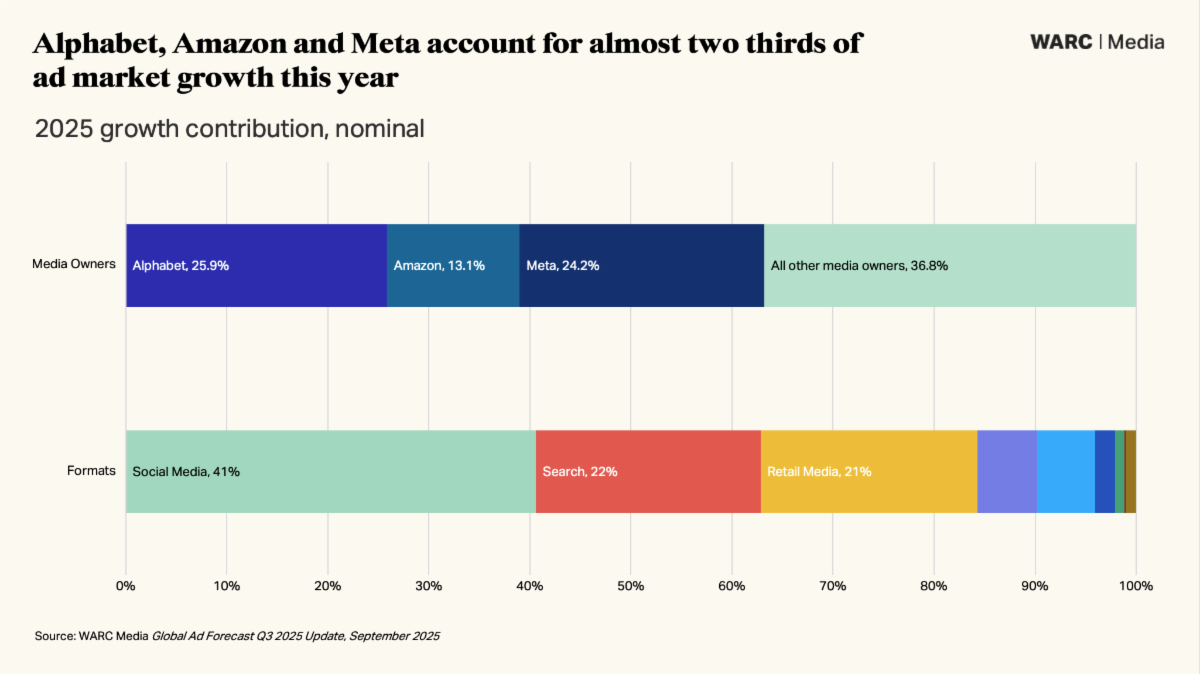

Nine in ten incremental ad dollars this year are going to online-only platforms, with social media drawing the largest share (40.6%) of new spend, followed by non-retail search (22.2%) and retail media (21.5%).

Social media ad spend is projected to rise 14.9% this year to $306.4 billion, or more than a quarter (26.2%) of all advertising spend. By 2027, the channel is forecast to hit $386.9 billion (28.5% share).

Meta remains the dominant player, capturing 60.1% of all social media ad spend in 2025 with revenues of $184.1 billion, though its share is expected to dip slightly by 2027 as TikTok gains momentum. TikTok ad revenues are forecast to grow at an average of 21.6%, reaching 11.7% of social media spend by 2027.

Search advertising spend is expected to grow 10.0% this year to $253.2 billion, with Google retaining an 86% market share ($217.8 billion) despite ongoing antitrust scrutiny in the US. Retail media is also on track for steady growth, with ad spend predicted to rise 13.7% in 2025 to $175 billion, led by Amazon’s $62 billion share.

Consolidation Among Big Tech

Together, Alphabet, Amazon, and Meta are forecast to command 55.8% of all ad spend outside China in 2025 – equivalent to $524.4 billion – rising further to 56.2% in 2026. Their combined dominance is projected to surpass 60% by 2030.

Q2 Windfall Ahead of Tariffs

The upgraded forecast was driven largely by a 20.2% surge in social media ad spend in Q2 2025, well above projections. Retailers and tech brands accelerated spend in the lead-up to “Freedom Day” – the introduction of new US trade tariffs. Retailers boosted outlay sharply on Instagram (+18.8%) and TikTok (+56.8%), while tech and electronics brands also lifted investment across platforms.

Post-Pandemic Market Dynamics

By 2027, the global ad market is set to double in nominal value compared to 2020. Clothing, travel, and nicotine brands will lead sector growth, while media & publishing faces real-term declines. Traditional channels such as magazines (-49.9%), newspapers (-45.8%), and broadcast TV (-35.2%) are on track for steep reductions in spend.

Meanwhile, Amazon’s retail ad business will be 3.1x larger in 2027 than in 2020, while Alphabet’s revenues rise 66.6% and Meta’s nearly double (+99.2%). Collectively, the “triopoly” is set to record real growth of 89.1% between 2020 and 2027, nearly five times faster than all other media owners combined.