Bank of Baroda has been lauded for its performance metrics. It crossed a significant milestone on market capitalisation recently. Is there a measure of where BoB stands in terms of brand salience among consumers, corporate and individual? What are the brand metrics?

Bank of Baroda (BoB) is currently India’s second largest public sector bank. We have a customer base of more than 15 crore. It is always a challenge to see how the brand exactly moves. Nevertheless, as a brand we have made various studies. We are also measuring how the brand is being viewed by various segments. Recently, we conducted a survey in terms of customer experience across all our branches that gave us deep insights on brand perception in the consumer’s mind. In terms of marketing, our aim is to target the youth segment more. That is where bob World and other digital offerings are going to strengthen the brand image.

We have certain metrics. In the near future, we will also conduct specific surveys/studies on brand recall, impact of brand activities and other aspects. We are planning to partner with leading research agencies to get more specific inputs on the same.

Without getting into the nitty gritties of banking, broadly, what percentage of the business is B2B and how much is B2C? Or, how do you bucket the businesses?

On the loan part of our business, 42 pc of our domestic book is corporate, retail is 22 pc, agriculture is 15.6 pc and MSME is 13 pc. On the liabilities side also we have similar percentages. We want to increase our retail business from the present status, that’s why we are focusing on digital lending in the retail segment.

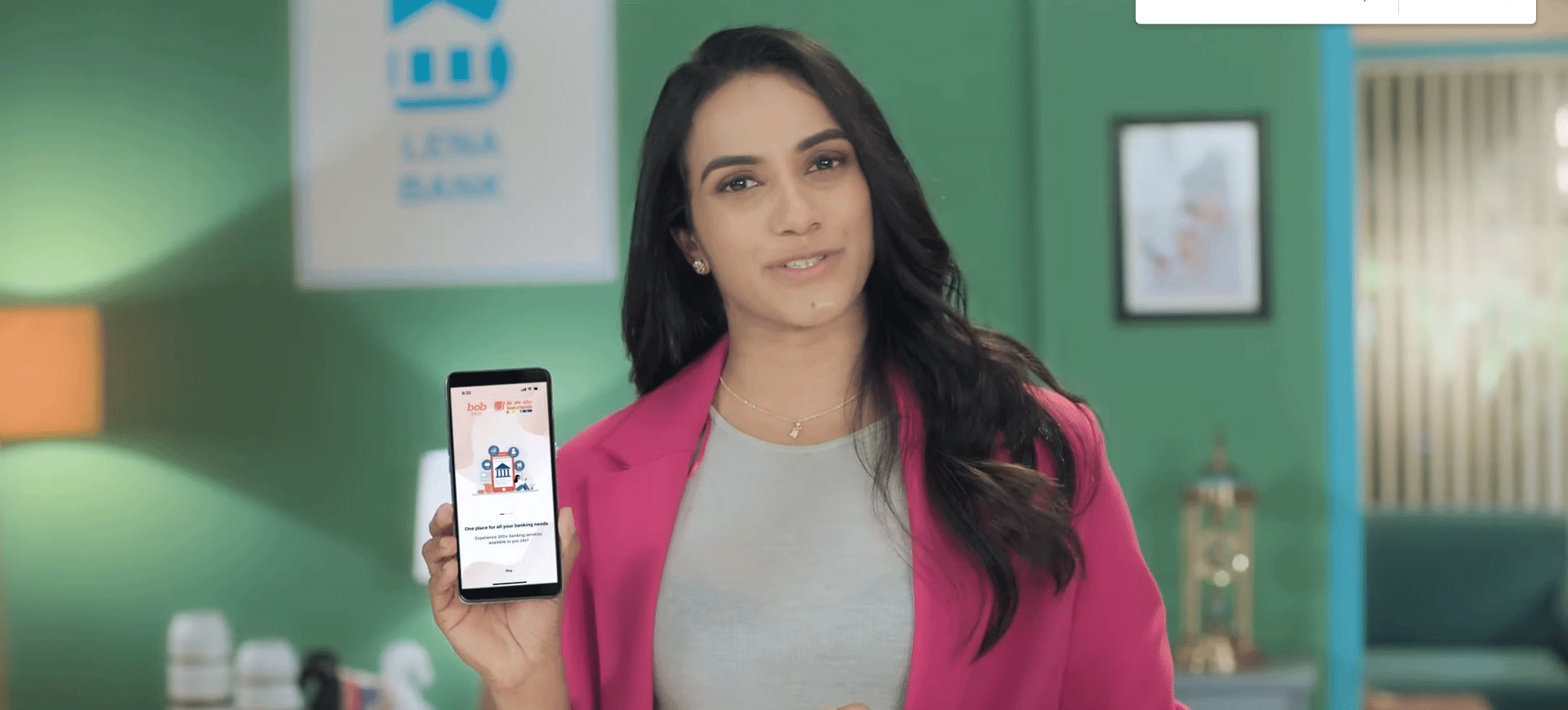

#LoansWithoutDrama – home and car loan TVCs were launched during the inaugural edition of the Women’s Premier League (WPL). Bank of Baroda was an associate media sponsor, in line with the philosophy to back emerging Indian sporting talent, particularly women. Your brand endorser Shafali Verma played in the first edition. What has been the response to the association? How do you plan to build on it?

Bank of Baroda has three brand endorsers – PV Sindhu, K Srikanth, and the latest addition Shafali Verma. If you go back a bit you will understand that we haven’t taken these endorsers during their peak period in their career, but we have identified them earlier in their career path. BoB has a unique intuition to identify talent and put in efforts to build their career along with the brand growth. In this way, Shafali Verma was the latest addition. I have seen several media reports projecting her as a cricketer with a bright future; the aggressiveness and the efforts Shafali Verma has demonstrated in the U19 matches and WPL is commendable. Due to time constraints, we couldn’t leverage the association to the maximum. We have detailed plans for this financial year, where we will be leveraging the association in a more productive way which will align with the brand’s strategies.

The #LoansWithoutDrama campaign was targeted at the young audience. When it comes to association with WPL, it was the management decision and view that we have to concentrate on women-centric sports/events. In India, cricket is generally considered as a men’s game. We were part of WPL, not only as a brand association but we wanted to give the necessary support for women’s cricket in India. It has given very good results for BoB.

The #LoansWithoutDrama campaign was targeted at the young audience. When it comes to association with WPL, it was the management decision and view that we have to concentrate on women-centric sports/events. In India, cricket is generally considered as a men’s game. We were part of WPL, not only as a brand association but we wanted to give the necessary support for women’s cricket in India. It has given very good results for BoB.

You have recently launched #bobWorld campaign – again featuring two sportspersons alongside celebrated film talent, the late Satish Kaushik – that will be played on social media and across cinemas in India. How is the media spend split for BOB overall and how is it changing? (Cinema advertising, Digital, Print, OOH etc.)

The #bobWorld campaign has given good mileage to the brand. It has also helped in positioning our message to the target audiences. If you ask about digital spends, our objective is to be more on digital – it is going to complement BoB’s digital push specifically on the mobile app, digital lending etc. The advantage of digital is that we can measure the investments we have made in promoting our products and services. We are certainly going to increase our spends on digital in comparison with traditional mediums. Our marketing spends earlier were 30 pc digital and the rest was traditional. Going forward, we might increase digital spends to 40 to 50 pc.

There are 30 million customers using the bob World app. How do you see the base growing?

We launched bob World in 2021. In the first year we worked towards increasing the customer base to a million. In the last financial year we crossed the 30 million mark. We will be part of Open Banking as well. Open Banking is a system that provides third-party access to financial data through the use of application programming interfaces (APIs). BoB will be one of the first banking players to move into that system. I believe that will give a boost to the numbers we are planning to close this financial year. As mentioned, we are increasing our digital spends and more focus will be given to app downloads.

Are there non-BoB customers who have come into the fold via the app? What are the most used services within the app?

In terms of volume, financial transactions are at 30 pc and non-financial transactions are also witnessing good growth. Fund transfer and balance check are the most frequently used services by active and quality customers. We are actually going to target non-BoB customers in a strong way. We are focusing on providing a seamless service and experience to the non-BoB customers coming on to the platform.

BoB is a legacy brand of 115 years with a global customer base of over 150 million and 8,200 branches. It is also famous for NRI Banking. How much of the customer base is outside India? How many of the branches are outside India?

The international business accounts for 18 pc of global advance book. I don’t have information on customers right now. We have 93 overseas branches and offices.

For a legacy brand like BoB, what are the primary marketing objectives – within India and internationally?

We want to scale the activities and optimise our channels of marketing. That’s where maybe a centralised approach both for international and domestic will pave the way in the near future.

Coming to strategies, as I said we want to target the young segment which is the prime objective of all our campaigns, particularly the millennials segment which is generally targeted by the BFSI sector. Hence, that will be our core targeted area. Digital spends are going to be increased and monitored on a RoI basis, and the brand strength that will come through these strategies.

It was widely regarded that rural India was underserved when it came to banking. How has this changed? What is BoB’s presence in rural India? How has this grown?

We have scaled down our branches after the amalgamation due to the synergy exercise. We are at around 8,200 branches of which rural is 35 pc, semi-urban is 25 pc and 40 pc in metro and urban. But, when you see our business correspondents, we have more than doubled, at more than 51,000. In Pradhan Mantri Jan Dhan Yojana account which is predominantly for financial inclusion for the rural and semi-urban areas, we have a strong market share at 17.5 pc. That reflects the kind of focus and attention to rural India in addition to our other initiatives.

There is a view that whenever there is a trust issue in areas like banking and finance, in general, consumer trust in PSUs goes up. Does this hold true in your view? Has this been evidenced in recent times?

It holds true and should continue. The fact is that in PSUs the employee service period is almost a career; when it comes to service and trust it is the employee who is involved with the customers. Since the relationship is going to be on the longer side when it comes to PSU banking, it has its own advantages. When you have a longer career with public sector banks, we tend to have longer relationships with the customers and we also look at the longer outcomes. More than the trust, our appetite to service our customers will be over the longer term.

There is also a view that younger customers are more attracted to new age private entities. What is the profile of the personal banking BoB customer today? Is there a generational loss in customer transition?

I don’t think so – that’s what we are working on, not to have generational loss. The way our digital transformation is happening, it should be a natural course for transition. If a financial institution or bank doesn’t move aggressively on the digital front, generational transition will remain a bigger challenge.

When it comes to personal banking, we have an equal mix of millennials and also the middle age group. Senior citizens also form a very significant number in our profile. It is evenly distributed.

What are the marketing and product efforts to attract younger customers?

bob World is a product that offers solutions to all the requirements of consumers, specifically the younger base. We have our B3 account which is the digital-only savings account which has got a lot of loyalty incentives attached to it like OTT subscriptions, rewards, cash back etc. In this account, we can say that around 90 pc of customers are less than 40 years of age.

The likes of GPay and PhonePe, Ola Money and PayTM and more – many of them are today gateways for loans, investments, recharges and so on. How does a BOB or bob World stand out?

The main strength BoB has when compared to all of these platforms is that we have the platform and also the servicing units which are our branches. We have more than 80,000 staff who have a long-term view in servicing customers. That differentiates us. Today you can build a platform but you cannot build an enterprise resource for servicing. When it comes to customer service, we always have our branches to rely upon and not only the platform to address issues.

BoB is continuously building strategies in aspects of our business, digital growth, products etc. In every aspect, the brand is on a transformation path. And we always have the strong legacy to back us.

(First published by The Free Press Journal BrandSutra. Content powered by MediaNews4u.com. Feedback: [email protected])