Mumbai: The digital advertising ecosystem in India is witnessing an unprecedented surge. According to the TAM AdEx Half Yearly Report on Digital Advertising (Jan–Jun’25), ad impressions on digital platforms doubled in the first half of 2025 compared to the same period last year, underlining the medium’s growing dominance in the media mix.

Services Sector Continues to Dominate

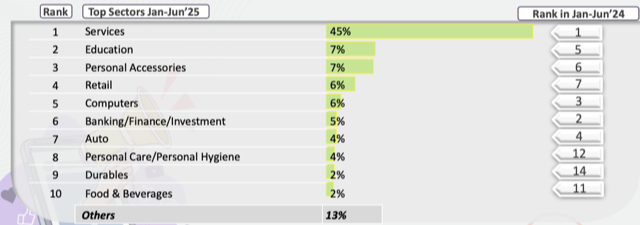

The Services sector retained the lion’s share of digital ad impressions at 45%, far ahead of other industries. Within services, categories such as e-commerce, education, and entertainment accounted for significant traction. Education and Personal Accessories followed at 7% each, while Retail and Computers claimed 6% each. Banking/Finance/Investment contributed 5% and Auto 4%.

Interestingly, three new sectors broke into the Top 10 – Personal Care/Personal Hygiene, Durables, and Food & Beverages – signaling a shift as traditional FMCG and consumer durables increase their reliance on digital advertising.

E-Commerce Tops Categories with Explosive Growth

Within categories, Ecom–Online Shopping emerged as the clear leader with 12% share, registering a 2.5X increase over H1 2024. E-commerce in fashion, education, and entertainment also made strong inroads. The Top 10 categories together contributed 41% of total digital ad impressions, with five of them coming from the services sector.

Notably, categories such as Retail Outlets–Clothing/Textiles/Fashion (10X growth), AV Auxiliaries (13X), Ecom–Wallets (10X), and Footwear (4.7X) saw exponential growth, reflecting consumers’ widening digital adoption across sectors.

Adobe Tops Exclusive Advertisers

The report highlights 1.1 lakh+ exclusive advertisers on digital platforms during the six-month period. Adobe Software India emerged as the top exclusive advertiser across digital and television, followed by Blink Commerce, Grammarly, Dubai Tourism Promotion Board, Interviewbit, Hostinger International, and Lenovo. These names underscore the dominance of digital-first global brands, SaaS players, and new-age edtech platforms in the advertiser landscape.

Instagram Tightens Grip as Leading Publisher

When it comes to digital publishers, Instagram accounted for a staggering 63% of ad impressions, consolidating its position as the platform of choice for advertisers. Facebook (14%) and YouTube (9%) followed, with X.com (5%) rounding off the top four. Together, the top five platforms commanded 92% of all digital ad impressions, underscoring the overwhelming dominance of social media in India’s advertising economy.

Display and Programmatic Lead Digital Advertising

On formats, Display ads led with 90% share, while Video contributed 10%. The buying ecosystem was overwhelmingly programmatic, with 95% of ad impressions delivered via programmatic routes, compared to just 2% through ad networks and 1% through direct deals.

The TAM AdEx findings reflect a two-pronged trend:

- Scale and penetration – Digital’s ability to deliver volume has doubled within just a year.

- Diversification of advertisers – Traditional FMCG and durables are joining e-commerce, edtech, and SaaS in shifting spends online.

As India’s digital economy continues to expand, these trends signal that advertisers are not only consolidating around platforms like Instagram and YouTube but are also increasingly relying on data-driven programmatic strategies to reach consumers efficiently.

In essence, digital advertising in India is no longer an add-on but the central pillar of brand strategy in 2025.