Mumbai: Media Partners Asia (MPA) has released Asia-Pacific Video & Broadband 2026 (AVB 2026), its flagship annual report assessing the region’s evolving video and broadband landscape. The study highlights that while Asia-Pacific’s total screen revenues will continue to grow through 2030, the momentum is increasingly concentrated in streaming, social video and connected TV (CTV), even as traditional television faces sustained structural pressure.

According to the report, between 2025 and 2030, premium video-on-demand (VOD) services—including subscription video-on-demand (SVOD) and branded or premium advertising-supported VOD (AVOD)—are projected to add approximately US$12.5 billion in incremental revenue, reaching US$52 billion by the end of the decade. Over the same period, user-generated and social video platforms are expected to expand revenues by US$11.4 billion to US$44.5 billion, positioning creator-led platforms as the single largest growth engine in the Asia-Pacific screen economy.

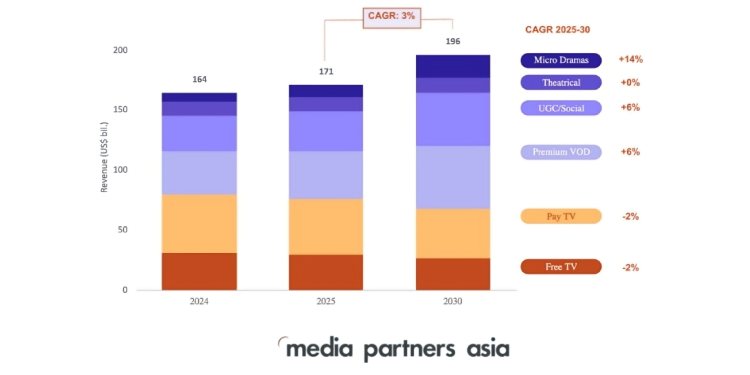

In contrast, traditional television revenues are forecast to decline by a cumulative US$8.0 billion, reflecting continued weakness in linear advertising and pay-TV subscriptions across the region.

Commenting on the findings, Vivek Couto, CEO and Executive Director, Media Partners Asia, said, “Value is shifting decisively toward streaming, social platforms and CTV-led monetization. Markets with scale, pricing power and strong local content ecosystems will continue to outperform, while traditional television economics face long-term structural erosion. What differentiates winners in this cycle is not volume alone, but the ability to monetise premium experiences, anchored by sports, high-quality local programming, emerging formats such as micro-dramas, and increasingly by AI-enabled efficiency across the content value chain.”

The report notes that Asia-Pacific screen industry revenues are set to grow at a 2.8% CAGR between 2025 and 2030, crossing US$196 billion, with all net growth coming from online video, which is forecast to expand at a 7% CAGR. Premium VOD growth will be led by Japan, China and India, followed by Australia, South Korea and Indonesia.

India is expected to overtake China to become the largest SVOD subscription market by 2030, with an estimated 358 million individual subscriptions. However, despite rapid growth, India’s combined premium VOD revenues from subscriptions and advertising will remain 4.5 times smaller than China’s and 2.5 times smaller than Japan’s.

User-generated and social video revenues are being driven primarily by advertising growth and expanding CTV inventory, with China, Japan, India and Australia leading the expansion. Meanwhile, the contraction in traditional television revenues will be most pronounced in China, Japan and India, which together account for nearly 70% of the projected decline.

The report also highlights increasing platform concentration, with the top 15 online video platforms accounting for 58% of total online video revenues in 2025. Global leaders such as YouTube, ByteDance’s Douyin and TikTok, and Netflix dominate the landscape, alongside strong national champions including JioHotstar and U-NEXT.

Asia-Pacific Video & Broadband 2026 (AVB 2026) offers a comprehensive, data-driven assessment of streaming, user-generated and social video, free-to-air TV, pay-TV, connectivity and theatrical exhibition across 14 Asia-Pacific markets. Built on proprietary bottom-up models, extensive primary research and detailed platform- and country-level analysis, the report provides forecasts through 2030 and serves as a key strategic resource for media companies, streaming platforms, telecom operators, investors and policymakers across the region.