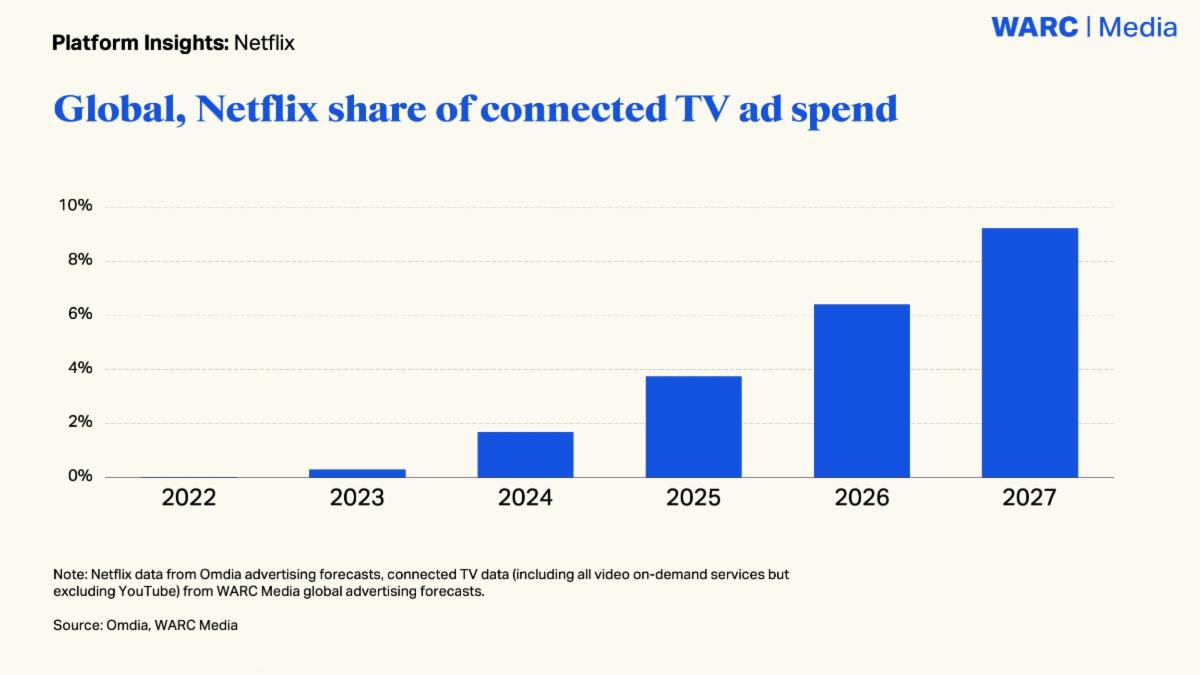

Mumbai: Netflix is on track to secure nearly 10% of global connected TV (CTV) ad spend by 2027, marking a significant shift in its revenue mix as the streaming giant accelerates its ad-funded strategy, according to a new Platform Insights report by WARC Media.

While subscription fees remain the dominant revenue source, advertising is emerging as a major growth engine. Ad revenue surpassed $1.5bn in 2025, accounting for 3.3% of total revenue, and is projected to double to $3bn in 2026 and rise to $8bn by 2030, according to Omdia data cited in the report.

Celeste Huang, Media Insights Analyst, WARC Media, and author of the report, said, “With ad revenue set to double to $3bn by 2026, and with an eye on a growing slice of the streaming ad pie, Netflix is expanding beyond video into a global entertainment hub. It increasingly attracts ad dollars and share of market boosted by live sports, cultural events, Gen Z’s love for brand integrations, and is perceived to be trustworthy by both brands and viewers alike.”

Investment Momentum and Competitive Strategy

According to WARC Media’s global CTV ad spend data, Netflix’s share of CTV advertising is expected to rise from 3.7% in 2025 to 9.2% in 2027. The company is targeting competitor share gains rather than relying solely on overall market expansion.

Strategic moves under consideration include a potential acquisition of Warner Bros. Discovery, which would broaden content and bundling opportunities, enhancing monetisation of its high-attention audiences.

Beyond core video streaming, Netflix is expanding into video podcasts—positioned as a modern evolution of talk shows—alongside cloud gaming across mobile and TV platforms. These initiatives aim to extend IP engagement, improve retention, and fill engagement gaps.

In the US, top advertising categories on Netflix in Q2 2025 included shopping ($82m), consumer packaged goods ($78m), financial services ($66m), travel and tourism ($54m), and telecoms ($44m), according to Sensor Tower data.

Global Reach and Consumption Trends

Netflix’s global audience is nearing 1bn, with members collectively consuming approximately 200bn hours annually. In Q4 2025, global paid subscriptions reached 315m. In key markets such as the UK and the US, Netflix accounted for over half of subscription video-on-demand (SVOD) viewing.

However, the broader SVOD market faces challenges including declining per-user viewing time and competition from free platforms such as YouTube, particularly among younger audiences. Netflix is responding by focusing on “premium storytelling,” algorithm-driven personalisation, and leveraging its extensive originals library to foster identity-driven fandoms across interactive and audio experiences.

The platform has also successfully attracted high-net-worth individuals in North America and Latin America, with future growth opportunities identified in APAC and lower-income segments, according to Ipsos Global Influentials data referenced in the report.

Brand Perception and Gen Z Engagement

Advertisers view Netflix as a premium and brand-safe environment. It ranks fourth among best-perceived “trustworthy” global platforms—behind YouTube, Instagram, and Google—and stands out for strict content curation compared to user-generated-content-driven platforms, per Kantar.

For Gen Z audiences, brand integration within Netflix intellectual property plays a significant role. According to the report, 70% of Gen Z viewers are more likely to trust brands that demonstrate a deep understanding of their favourite fandom shows, and 74% are more likely to purchase from brands aligned with those fandoms.

As Netflix evolves into a broader entertainment ecosystem spanning streaming, live events, gaming, and podcasts, its advertising business appears set to become a central pillar of its long-term growth strategy.